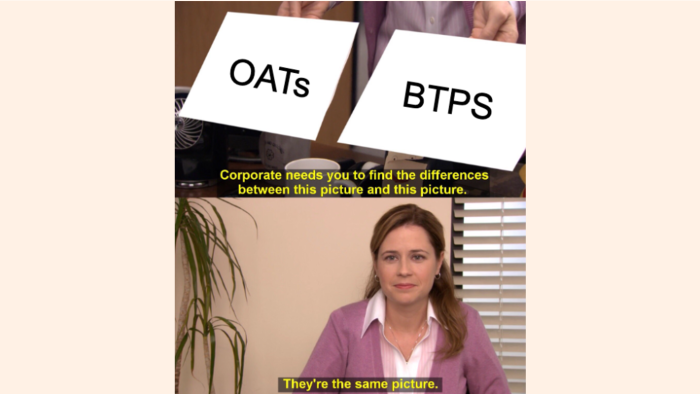

Keep knowledgeable with free updatesSimply signal as much as the Sovereign bonds myFT Digest — delivered on to your inbox.Eurozone sovereign bonds — not like US, UK, or Japanese bonds — usually are not issued by governments that may, just about, make up new stuff and name it cash.As such, yield variations between bonds of the identical tenor carry some info as to the market’s expectations for the probability of default.Bond pedants will object that additionally they include details about liquidity choice, relative ranges of home monetary repression, and a bunch of different issues. And certain.However nonetheless, it’s kind of fascinating — in a Friday afternoon kind of means — to see that France has began to commerce at an expansion over *checks notes* Italy.We observed two-year BTPs buying and selling by two-year OATs again in Could. However frankly, two-year bonds is usually a bit bizarre. Two-year BTPS traded by OATs briefly on the finish of 2023 and the start of 2024. We simply assumed that this was one other a type of occasions and didn’t give the matter a lot thought.Some content material couldn’t load. Test your web connection or browser settings.However this week the unfold of five-year BTPS over five-year OATS has flipped from optimistic to destructive: Some content material couldn’t load. Test your web connection or browser settings.This appears prefer it’s a much bigger deal. So far as we are able to see, it’s been over 20 years since France traded by Italy on the five-year tenor level. And it’s truthful perhaps to name 2005 the ‘earlier than occasions’ — when European sovereign debtors have been seen as a lot of a muchness and sovereign spreads have been just about meh.Looking to 10 and 30 years, Italian bonds nonetheless provide increased yields than their French bond counterparts. However they’re more and more seen as a lot of a muchness:Some content material couldn’t load. Test your web connection or browser settings.Has Meloni wowed the market into understanding Italy to be now devoid of credit score threat? Nope. That is all about buyers turning into incrementally much less prepared to take French threat with out being extra generously compensated. We predict French and Italian spreads over five-year swaps tells this story most cleanly:Some content material couldn’t load. Test your web connection or browser settings.If anybody wants reminding of the human and financial prices that may comply with when the bond market cuts a authorities’s credit score line (and the central financial institution received’t step in) they might do worse than learn MainFT’s spectacular Large Learn right this moment on How Greece got here again from the brink.However earlier than we get too carried away with concepts in regards to the market pricing in an incipient collapse of the Fifth Republic, let’s mirror that we’re nonetheless a great distance from Eurozone disaster ranges. And lengthy might they keep that means.

Trending

- Arthroscopy specialist answers whether walking for 45 minutes every day before hitting the gym is a good idea | Fitness News

- Netherlands cracks down on China-owned chip firm over security risk

- “Best marketing I’ve ever seen”: Back Market’s powerful iPhone ads have viewers floored

- Rachel Reeves should avoid ‘half-baked’ tax fixes in Budget, says IFS

- Report Suggests That Posting More Often Increases TikTok Performance

- The kindness of strangers: a woman paid for my groceries when I couldn’t | Life and style

- The 7 Principles of Exceptional Wildlife Photography

- HT City Delhi Junction: Catch It Live on 13 October 2025