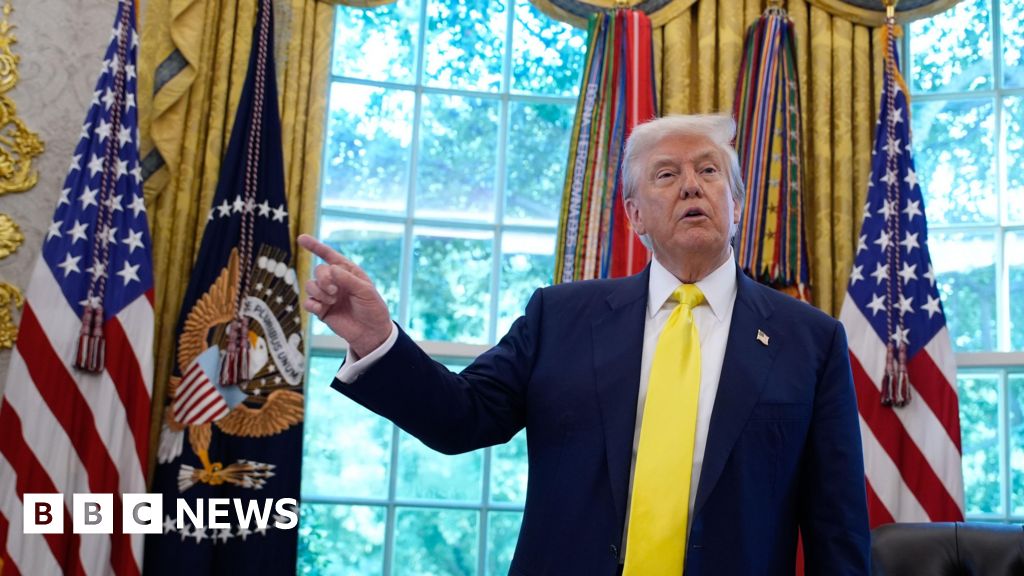

US President Donald Trump is pushing to make it simpler for People to make use of retirement financial savings to spend money on cryptocurrencies, non-public fairness, property, gold and other forms of non-traditional belongings. On Thursday, he ordered regulators to search for methods to vary guidelines that may discourage employers from together with such choices in office retirement accounts, identified within the US as 401ks. The transfer is meant to ultimately give on a regular basis employees new entry to investments previously reserved for rich people and establishments, whereas opening up beforehand untouched swimming pools of funding for corporations in these fields. However critics say it might enhance dangers for savers.Most employers within the US don’t provide conventional pensions, which include a assured payout after retirement. As an alternative, staff are given the choice of contributing a part of their pay cheque to funding accounts, with employers sometimes bolstering with further contributions. Authorities guidelines have traditionally held the corporations providing the accounts chargeable for contemplating components similar to danger and expense. Prior to now, employers have shied away from providing investments like non-public fairness, which frequently have larger charges and face fewer disclosure necessities than public corporations and might be much less simple to transform to money. The order provides the Division of Labor 180 days to assessment guidelines and consultants mentioned any change was unlikely to be felt instantly. However funding administration giants similar to State Avenue and Vanguard, identified for his or her retirement accounts, have already introduced partnerships with the likes of different asset managers Apollo World and Blackstone to start out providing private-equity centered retirement funds. Trump’s private enterprise pursuits embody corporations concerned with crypto and funding accounts. The Division of Labor in Might rescinded steerage from 2022 that urged corporations to train “excessive care” earlier than including crypto to funding menus in retirement accounts.Throughout Trump’s first time period, the Division of Labor issued steerage aimed toward encouraging retirement plans to spend money on non-public fairness funds, however considerations about litigation restricted take-up and former President Joe Biden later revoked it.

Trending

- New £150m funding package to protect jobs at Grangemouth

- Jared Kushner’s firm exits takeover battle for Warner Bros Discovery | Media

- Learner drivers face 24-week wait as backlog continues for two more years

- Nikon Z9 Firmware 5.30 Released – Expanded Subject Detection, Focus Limiter, and Flexible Color Picture Control

- Nielsen’s The Gauge Ratings for November 2025

- EU waters down plans to end new petrol and diesel car sales by 2035

- A Tale of Two Clocks: Making Both Brand Performance and Value Tick

- Former chancellor George Osborne joins OpenAI