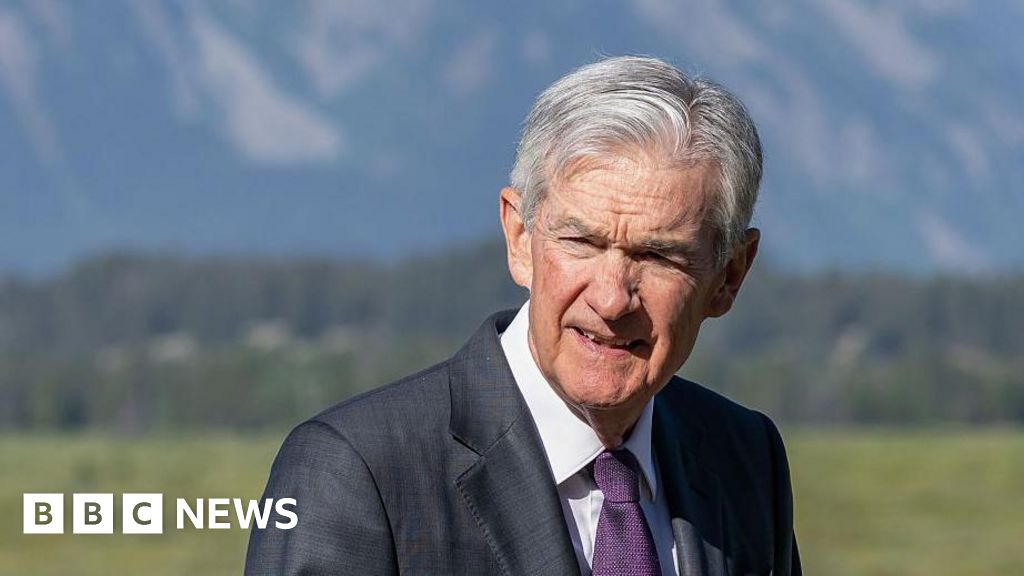

Jerome Powell, the top of the US central financial institution, has given a rocket enhance to expectations that there can be an rate of interest minimize in September, a transfer President Trump has been demanding for months. Talking to central bankers gathered at Jackson Gap, Wyoming, Powell additionally argued that the inflationary influence of Trump’s tariffs might show short-term.However he didn’t, as some had anticipated, deal with the extra challenges he has confronted in current months: the political strain exerted on the US central financial institution, Trump’s barrage of name-calling and calls for for Powell to be faraway from his put up.The shift to a extra “dovish” stance, suggesting an easing of the price of borrowing, despatched share costs increased.Economists and buyers have been already anticipating borrowing charges to come back down from their present 4.25 to 4.5% vary. Current weak point within the US jobs market raised these expectations additional, however the influence on costs of Trump’s sweeping tariffs had raised doubts.”Within the close to time period, dangers to inflation are tilted to the upside, and dangers to employment to the draw back—a difficult scenario,” Powell mentioned.Central banks sometimes minimize charges to spice up development if there are indicators of slowing economic system and falling employment, because it makes it cheaper for customers and companies to borrow.However boosting development must be balanced with holding a verify on rising costs. Greater rates of interest will help management inflation, which is usually seen as a central financial institution’s principal precedence.Powell mentioned the consequences of tariffs on client costs have been now “clearly seen” however mentioned that there was a “affordable” case to be made that inflation could be “comparatively quick lived – a one-time shift within the worth degree”.He mentioned it could take time for the value adjustments to work their manner by means of, however he downplayed the chance of inflation turning into embedded resulting from elevated wage calls for, or increased inflation expectations.As rates of interest have been already “in restrictive territory” – excessive sufficient to be having a dampening influence on financial exercise – Powell urged that “the shifting steadiness of dangers could warrant adjusting our coverage stance”.The one time Powell appeared to make reference to the additional strain exerted by the Trump presidency was when he cautioned towards a presumption {that a} September price minimize was set in stone.He mentioned: “Financial coverage will not be on a preset course”.Members of the coverage making committee would take the choice “based mostly solely on their evaluation of the information and its implications for the financial outlook and the steadiness of dangers.”We’ll by no means deviate from that method,” he mentioned.Friday’s speech is prone to be Powell’s remaining deal with to the annual gathering of the nation’s central bankers in Jackson Gap, as his time period involves an finish in Might 2026.He was appointed chairman of the Federal Reserve by Trump in 2017.Since then nevertheless Trump has expressed growing animosity, hurling private insults on the central banker, together with calling him a “numbskull” and a “cussed moron”, as a result of he didn’t assist the president’s requires fast, massive cuts to borrowing charges.Trump has additionally publicly raised the concept of eradicating Powell from his put up early, though it’s not clear that he has the authorized authority to take action.Earlier this week the president referred to as for an additional of the Fed’s officers, Lisa Prepare dinner, to resign, over alleged mortgage fraud. She mentioned she wouldn’t be “bullied” into leaving.Buyers welcomed Powell’s speech, pushing the principle American share indexes sharply increased within the minutes after he started talking. By noon buying and selling within the US, the broad S&P 500 index was round 1.5% increased on the day.Brian Jacobsen, chief economist at Annex Wealth Administration, mentioned the Fed had opted towards being the “party-pooper”.”Chair Powell has proven he has an open thoughts to studying the information tea leaves,” he mentioned.Diane Swonk, chief economist at KPMG US mentioned: “Powell opened the door a bit wider to a minimize in charges in September.”However she mentioned the Fed clearly remained involved concerning the danger of rising costs.”There’s extra warning than the markets are giving him credit score for,” she mentioned.Capital Economics’ deputy chief North America economist, Stephen Brown, mentioned that whereas a September price minimize now seemed “virtually nailed on”, increased job creation or “way more regarding” worth knowledge in August might nonetheless set off a delay.

Trending

- No toolkit to deal with Covid economic crisis, says Sunak

- Why universal basic income still can’t meet the challenges of an AI economy | US economy

- Godox KNOWLED MG4K Walkthrough Video Breaks Down the High-Efficiency LED

- A hurricane destroyed their homes in Jamaica. Now they face losing the jobs they relied on in the US | US immigration

- The 7 Media Trends That Defined 2025

- Airbnb fined £56m by Spain for advertising unlicensed properties

- Investors hunt for protection against AI debt bust

- ‘We were sacked from Rockstar North for trying to unionise’