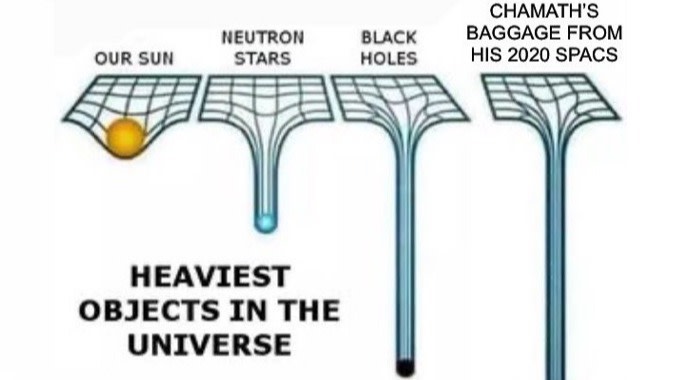

Unlock the Editor’s Digest for freeRoula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.Chamath Palihapitiya is again! The self-styled “Spac King”, whose blank-cheque offers incinerated billions of investor {dollars}, has introduced he’s “in all probability” launching one other one. That’s regardless of an abysmal document and the overwhelming thumbs-down verdict of a 58,000-person X (previously Twitter) ballot. “The final time wasn’t successful by any means,” he magnanimously admitted.Unbelievable that nearly 58k individuals voted. I hope everybody that voted “No” feels seen. Now onto enterprise. I obtained calls from many Wall Avenue and Crypto Titans yesterday. All of them need in and their vote issues loads to me so… I’ll in all probability do it. Perhaps this time it’ll… https://t.co/FXnxKXRTlB— Chamath Palihapitiya (@chamath) June 19, 2025

That’s one method to put it.Each funding prospectus consists of the usual SEC-mandated well being warning: “Previous efficiency just isn’t indicative of future outcomes.” It’s meant to cease traders from blindly pouring cash into the most recent scorching fund simply because it’s been on a tear. In Palihapitiya’s case, nonetheless, the disclaimer reads much less like boilerplate and extra like a punchline. Simply because almost all of his earlier Spacs have been dumpster fires doesn’t technically assure his subsequent one might be too.Palihapitiya’s timing couldn’t be higher: Goldman Sachs is claimed to be re-entering the Spac enterprise after three years away, and it appears different bulge-bracket funding banks gained’t be far behind. And possibly traders are prepared to wager on Palihapitiya’s redemption arc and wager that this clever, wildly wealthy man will flip over a brand new leaf and eventually ship worth for others, not simply to himself.Palihapitiya actually isn’t incorrect concerning the dangers. His Spacs have all lagged the S&P 500 since their first buying and selling day, with most both dropping some huge cash, a helluva some huge cash, or all of it. Buyers in two Spacs that have been wound down in 2022 with out discovering an acquisition turned out to have been lucky.But right here he’s, dusting off the outdated Spac playbook, maybe on the idea that collective reminiscence fades like a one-star TripAdvisor evaluation that scrolls out of view. Hope springs everlasting, as Alexander Pope wrote. Judgment, much less soBut we shouldn’t dismiss Palihapitiya’s newest musings solely. In a follow-up X submit, the previous Fb govt portrayed Spacs as a extra clear, virtuous various to conventional IPOs. Banks, he claims, quietly allocate IPO inventory to their favoured purchasers who stroll off with straightforward income on the expense of workers and early traders. He cites Circle’s IPO — the place shares have soared since their debut — as proof that the method is rigged. In keeping with Palihapitiya, the corporate left $3bn on the desk. “Worth is transferred to randoms, and it is senseless,” he thundered.This was what I hoped to repair with SPACs. It’s possible you’ll not like SPAC founder promotes or different types of worth switch to intermediaries however you may by no means declare it wasn’t disclosed.The Circle IPO, and ALL conventional IPOS, are the other. Worth is transferred to randoms and it… https://t.co/3QGTCLxeIL— Chamath Palihapitiya (@chamath) June 20, 2025

There’s only one teensy-weensy snag: Palihapitiya is the incorrect messenger. It’s galling to listen to Spac evangelism from somebody whose earlier blank-cheque (advert)ventures have burned traders so badly. And even when his factors aren’t solely incorrect, his evaluation is so reductive and self-serving that it’s onerous to take significantly. Sure, IPOs may be underpriced. Sure, banks allocate shares to institutional purchasers who typically flip them for fast features (though in my expertise the businesses themselves get closely concerned in deciding allocations). And sure, a giant first-day “pop” can imply a few of the firm’s worth has leaked to some well-connected traders. However the concept that Spacs are the sincere, easy various is derisory. Spacs have their very own set of warped incentives, and Palihapitiya ought to know that higher than anybody.The core flaw with Spacs is that their construction can encourage unhealthy offers. Spac sponsors get a juicy “promote” — sometimes 20 per cent of the fairness — merely for locating a merger goal and getting the deal finished, no matter how the inventory performs afterwards. But when they don’t pull it off inside two years, they lose the “at-risk capital” of round $5-10mn they put in initially. So the temptation is to do any deal, even a horrible one, simply to money in. Even when the share worth later halves, sponsors nonetheless stroll away with a windfall. To be truthful, Palihapitiya dissolved two of his Spacs in September 2022 with no deal, and traders obtained their a reimbursement, with curiosity. However by then, Palihapitiya’s Social Capital had already made $750mn in Spacs, and the overwhelming majority of Spac stockholders have been redeeming for money anyway, making it troublesome to consummate mergers.In keeping with Palihapitiya, if the sponsor promote rubs you the incorrect means, “you may by no means declare it wasn’t disclosed.” It is a peculiar means of endorsing the Spac mannequin. He’s overtly admitting the failings — at the same time as he’s reminding you that should you lose cash, that’s on you.As for his IPO critique, it misses the mark. Most offers don’t explode like Circle’s, and after they do, it’s often about tight provide (ie small free float) and hype, not some grand conspiracy to counterpoint FOBs (pals of bankers). And whereas the bookbuilding course of has its flaws, at the least it tries to find a market-clearing worth by testing demand. Additionally, it’s ludicrous to fake that issuers and their VC backers are helpless victims right here. These are refined gamers who know precisely what they’re doing and infrequently drive the important thing pricing and allocation selections.Spacs, in the meantime, rely on backroom negotiations to set valuations — a course of that may be simply as subjective (if no more so) than conventional IPO pricing. The one actual market test on comes at two junctures: if Spac stockholders elect to not redeem their shares for money earlier than the merger, and/or if outdoors traders commit recent capital to the merger by way of a PIPE (“non-public funding in public fairness”, ie the place establishments purchase shares at a negotiated worth). Whereas this isn’t fully indifferent from market actuality, it’s a far cry from the broader demand-testing of an actual IPO, the place underwriters canvass orders throughout the total gamut of institutional and retail traders earlier than setting phrases.Palihapitiya’s actual expertise isn’t Spacs or enterprise capital and even podcasting. It’s chutzpah. He has reframed his spectacular failures — from which he has profited enormously — as proof that he has realized the onerous means. As a result of his Spac mergers have been largely turkeys, you may belief him to know higher this time. It’s the type of reinvention that might occur solely in finance. Or possibly politics.