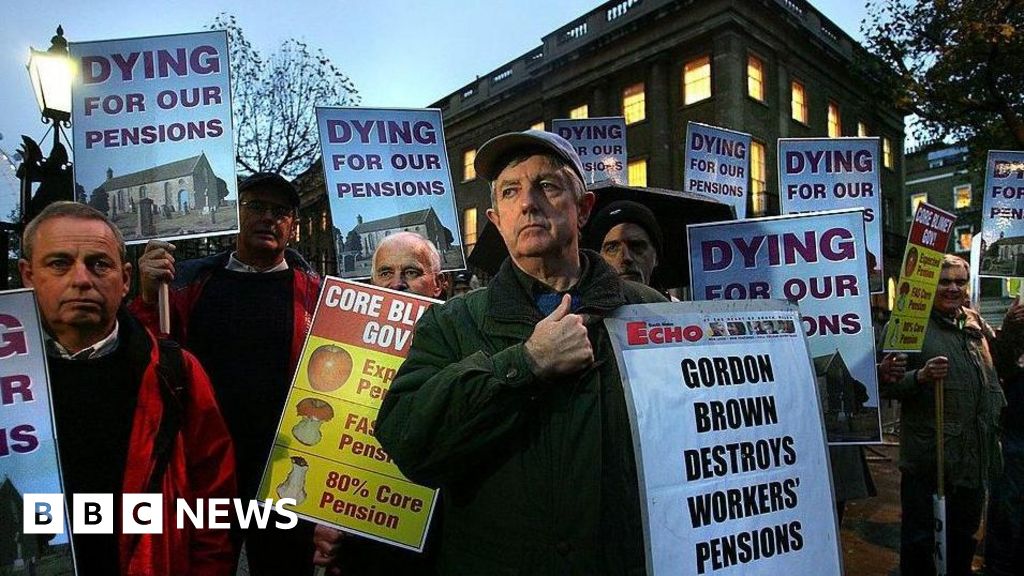

Rhodri LewisPolitical reporter, BBC Wales NewsGetty ImagesJohn Benson (entrance and centre) protesting with fellow ex-Allied Metal and Wire in London in 2007Pensioners from a plant in Cardiff who misplaced their pensions when it went bust greater than 20 years in the past have referred to as for surplus cash for use to compensate them.Staff from Allied Metal and Wire obtained 90% of their pensions again, however that has been eroded as a result of funds aren’t linked to rising costs.One among them, John Benson, mentioned “retirement desires” had been “destroyed” however that utilizing a small portion of a £13bn surplus within the Pension Safety Fund can be sufficient to totally restore the pensions.The UK authorities mentioned it was contemplating the matter however warned “these are advanced issues requiring a balanced method”.Pension protections had been strengthened after the Maxwell Scandal, when newspaper tycoon Robert Maxwell stole greater than £400m from the pension funds of his Mirror newspaper group to prop up his ailing companies.His pensioners misplaced half of what that they had paid in. Because of his motion, the Monetary Help Scheme was arrange as a security web to guard pensioners when the businesses they labored for went bust. It was this scheme that helped bail out a bunch of Welsh employees from Allied Metal and Wire (ASW) in Cardiff who misplaced out when the corporate went below in 2002. Though the ASW employees obtained 90% of their pensions, their worth has fallen since that point as they aren’t linked to rising costs.’It is destroyed me’Mr Benson, from Dinas Powys, Vale of Glamorgan, has led a protracted marketing campaign asking the federal government to make up the shortfall, which he mentioned has had dire penalties.”It is destroyed retirement desires. Some colleagues have needed to downsize,” he mentioned. “One woman who was significantly in poor health herself could not afford a funeral after her husband died, and a few months later she died herself. “It is soul destroying. It is destroyed me. “There are some horror tales, too many to inform.”John Benson has been campaigning on the difficulty for 23 yearsNow a cross-party group of Senedd members has written to the prime minister urging him to pay the pensions in full, amongst them the previous Conservative chief in Cardiff Bay Andrew RT Davies.”This can be a large injustice that is been inflicted on ASW pension holders and different pension holders throughout the UK,” he mentioned.”Via no fault of their very own, they’ve misplaced their entitlement to a full pension which they paid into, and we consider the system needs to be corrected and that is why we have signed this letter.”It has been revealed that the scheme which changed the Monetary Help Scheme, the Pension Safety Fund (PPF), has a surplus of £13bn.Mr Benson mentioned paying a tiny quantity of that cash to him and his fellow pensioners to make up the shortfall wouldn’t be a hardship, however would make all of the distinction to them.”This cash, this surplus within the PPF, needs to be paid to revive our pensions in full.”They have a £13bn surplus within the PPF – use it!”Cease making excuses that it is public cash – it is our cash. This cash is supposed for us, not different authorities insurance policies.”‘Any hope?’The matter was additionally raised with Pensions Minister and Swansea West MP Torsten Bell at a gathering of the Commons Work and Pensions Committee earlier this month.Committee chair Labour MP Debbie Abrahams requested: “I can’t perceive the explanation for not making a choice to allow them to spend the previous few years of their life in some consolation, are you able to give us any hope round this?”Bell replied: “It does should be checked out correctly.”It must be thought of within the spherical of these wider impacts, as all public coverage issues are, however I’m completely conscious of the problems.”I’m additionally conscious of the common age of the individuals which might be affected.”The perfect factor I can do is to say that I’m conscious and I’m taking a look at it, however the public finance implications are extra sophisticated than you set out.”In response, regarding its £13bn surplus, the PPF mentioned it intentionally had what it referred to as a reserve to guard it from future claims or in case individuals reside longer than anticipated.The Division for Work and Pensions mentioned it recognised members’ incomes could have been eroded in recent times.”Nonetheless, these are advanced issues requiring a balanced method,” it mentioned.”The federal government is continuous to think about what we’ve heard from the Pension Safety Fund and Monetary Help Scheme members on this problem.”

Trending

- Rashmika Mandanna’s 5 best ethnic looks that prove she will be a gorgeous bride: Regal anarkalis to delicate sarees

- Supermarket BOGOF ban takes the biscuit — and that’s no bad thing

- ‘Kaziranga welcomes an old guest’: Assam CM Himanta celebrates return of painted storks after 4 years | Pets-animals News

- 5 Signs You’re Not Ready for Professional Photography

- Disney’s stand against Character.AI is a small win for artists over AI

- What Are Jordan Peele’s Favorite Horror Tropes?

- Tell us: how have price rises affected your spending habits? | Money

- 100 (More) Terrifying Horror Writing Prompts