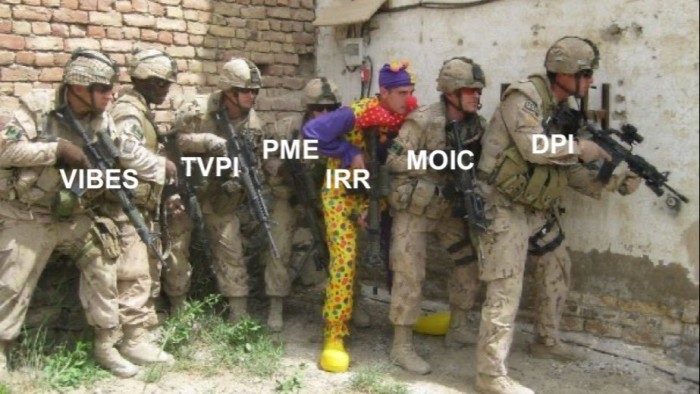

Keep knowledgeable with free updatesSimply signal as much as the Fund administration myFT Digest — delivered on to your inbox.We (ought to) all know (by now) fairly how terrible the “inner charge of return” is as a measure of your personal fairness supervisor’s long-term efficiency file. However this hasn’t stopped them bragging.Ludovic Phalippou, professor of monetary economics on the College of Oxford, hammered dwelling the purpose right here on FTAV on why the IRR measure is so pungent:Early money flows dominate the calculation, whereas later ones have nearly no affect. You may make investments for 40 years, make or lose billions — and your since-inception IRR will nonetheless replicate that good exit in 1980 or each time.It’s simple to nod sagely. Positive — some personal fairness managers might have interaction in a little bit of figuring out IRR bait and change. But when it’s so broadly used, IRR should at the very least have the capability of being a half-decent measure?A recent-ish paper by Simon Hayley of Bayes Enterprise Faculty and Onur Sefiloglu of Essex Enterprise Faculty argues not.The authors examine annualised inner charge of return measures derived from investor money flows calculated over various time horizons. They usually discover a structural upward bias that they reckon is value between two to 3 proportion factors each year. Two to 3 proportion factors each year is so much.To be clear, this isn’t about PE corporations jimmying their numbers with intelligent NAV loans and well-timed distributions. That is nearly maths. The upward bias “come up[s] with none deliberate manipulation by fund managers” and is “inherent within the observable statistical distribution of the cashflows generated by these belongings.’”What’s happening? We’re not going to bore you with the small print of the maths on a Monday morning, but it surely seems that IRRs will likely be upwardly biased when two circumstances are met. The primary situation is that there should be a excessive variation of returns for offers with short-term payouts. The second situation is that the offers’ maturity and returns should be not directly associated. Assume annualised returns from offers that take an age to pay out being reliably decrease than returns from offers that pay out rapidly.And what do personal fairness deal returns appear to be in follow? Analyzing 1,585 funding exits by 438 PE corporations with acquisition years from 1998 to 2018 Hayley and Sefiloglu draw this beautiful chart (zoomable model right here):Excessive variance of short-term deal payouts — aka are the dots on the left all over? Verify.A relationship between deal maturity and returns — aka do the dots resemble an enormous drop slide? Verify.How a lot does this sample of deal returns juice said IRRs? Once more — two to 3 proportion factors each year. And as Hayley and Sefiloglu observe:. . . These biases stay poorly understood. Consequently, many traders look like making substantial allocations to illiquid belongings on the idea of biased return measures.The largest personal fairness allocations are made by massive, refined institutional traders like sovereign wealth funds, personal banks, US college endowments and main pension plans. Until they’ve been burying their head within the sand for the previous twenty years we’d hope that this newest cause to be sceptical about IRRs doesn’t come as an excessive amount of of a shock.Nevertheless, it’s unlikely that retail traders have absorbed the complete unvarnished IRR canon. And sadly, retail traders are at the moment very a lot within the sights of wealth managers each the US and the UK.

Trending

- Nikon Z9 Firmware 5.30 Released – Expanded Subject Detection, Focus Limiter, and Flexible Color Picture Control

- Nielsen’s The Gauge Ratings for November 2025

- EU waters down plans to end new petrol and diesel car sales by 2035

- A Tale of Two Clocks: Making Both Brand Performance and Value Tick

- Former chancellor George Osborne joins OpenAI

- Color.io Shutting Down – Popular Film Emulation and Color Grading Tool Goes Offline December 31

- Kraft Heinz taps ex-Kellanova boss as new chief for looming break-up

- Can Buzzy Marketing Bring Back JCPenney? CMO Marisa Thalberg Is Betting on It