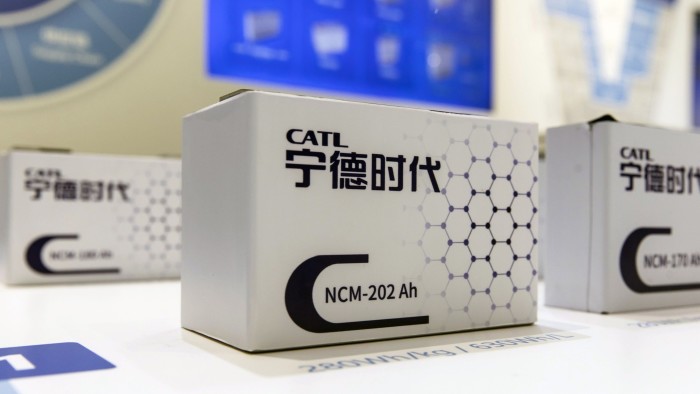

This text is an on-site model of our Power Supply e-newsletter. Premium subscribers can enroll right here to get the e-newsletter delivered each Tuesday and Thursday. Normal subscribers can improve to Premium right here, or discover all FT newslettersWelcome to Power Supply, coming to you at the moment from a sweltering London, the place a large heatwave has descended on town.It’s been a sizzling information cycle as properly, because the vitality trade digests the information that Shell won’t be bidding for BP — at the least not earlier than Christmas. In the meantime, a fragile truce stays in place within the Center East, the place hostilities between Israel and Iran appear to be on maintain for now. Should you’d like to check your data of how the oil market responded to earlier Center East crises, attempt your hand on the FT’s interactive “Draw your individual chart” sport. It’s tougher than you assume. And in at the moment’s Power Supply, my colleague Camilla Hodgson takes a take a look at the way forward for sodium-ion batteries — a possible rival to lithium-ion batteries — and whether or not they may be overhyped. Thanks for studying, LeslieSodium battery hype doesn’t match actuality, says new reportDemand for a brand new battery know-how utilizing sodium ions will develop slower than Chinese language electric-vehicle battery maker CATL expects, with hype outpacing real-world deployment, in line with new evaluation.The findings by analysis group Benchmark Mineral Intelligence, shared solely with the FT, discovered that forecasts by CATL in regards to the development of sodium-ion batteries have been unrealistic.The analysis finds that sodium-ion batteries, which make up lower than 1 per cent of the worldwide battery market at the moment, will symbolize about 3 per cent of batteries in a decade in a base case situation, and as a lot as 15.5 per cent in an “early adoption” situation.Sodium-ion batteries — that are made utilizing sodium salt — are seen as a less expensive various to lithium-based batteries, and work higher at very excessive and low temperatures. They’ve began for use in some giant, stationary vitality storage techniques, in addition to in electrical scooters in China.Nevertheless, they’re usually much less energy-dense relative to their measurement, which has held again their use in EVs, and have develop into much less cost-competitive for the reason that droop in lithium costs.Demand was nonetheless “comparatively small” for what was a “nascent know-how”, stated Benchmark.In April, CATL launched a brand new vary of sodium-ion batteries, which can begin mass manufacturing by the tip of the 12 months. Founder and chief govt Robin Zeng has stated he believes sodium-ion batteries might change as much as half of the marketplace for lithium-iron phosphate batteries.However Benchmark stated on Tuesday that was unrealistic. Though sodium-ion batteries “have a spot within the vitality transition”, the know-how was “not able to go mass-market and the present optimistic sentiment is pushed by hype”. Based on Benchmark, Zeng’s forecast would symbolize about 1.8 terawatt hours of sodium-ion batteries deployed by 2035. That might require “a direct breakthrough” within the know-how’s efficiency and price, and an increase in lithium costs, it stated. Against this, Benchmark’s most optimistic situation is for demand to achieve about 946 gigawatt hours by 2035, or simply underneath 1 TWh, an estimate that additionally assumed rising lithium costs amongst different issues. CATL and Chinese language carmaker BYD are among the many greatest producers of sodium-ion batteries.Fluctuating commodity costs have inspired improvements in battery know-how. Though lithium-iron phosphate batteries stay the dominant choice, a variety of options, together with sodium-ion and solid-state batteries, are additionally in growth.Sodium-ion provide chains have to scale as much as deliver down prices, and the know-how must be directed into areas the place it might “differentiate itself now that value isn’t compensating for weaker efficiency”, stated Connor Watts, an analyst at value reporting company Fastmarkets. That would come with the vitality storage market, the place they might not be competing instantly with lithium-based batteries on value. “Sodium’s continued enchancment is inevitable, however it would take one other few generational enhancements earlier than western customers might be satisfied to change over,” stated Watts. (Camilla Hodgson)Energy PointsEnergy Supply is written and edited by Jamie Smyth, Martha Muir, Alexandra White, Kristina Shevory, Tom Wilson and Malcolm Moore, with help from the FT’s international crew of reporters. Attain us at vitality.supply@ft.com and observe us on X at @FTEnergy. Atone for previous editions of the e-newsletter right here.Really useful newsletters for youMoral Cash — Our unmissable e-newsletter on socially accountable enterprise, sustainable finance and extra. Enroll hereThe Local weather Graphic: Defined — Understanding crucial local weather information of the week. Enroll right here

Trending

- Aiarty Video Enhancer Update Adds New AI Models and Control Options – Get 36% Off Now

- IAS Moves Beyond Verification With New AI Agent for Ad Campaign Optimizations

- Nissan Leaf production starts in Sunderland

- Sony ZV-E10 II gets 4K 120 fps recording with free upgrade

- Empty shelves fill Coventry food hub volunteers with dread

- ARRI Reaffirms Commitment to Lighting and Camera Systems – Full Roadmap for 2026, Munich Consolidation Underway

- Brussels to give carmakers breathing space on 2030 climate targets

- Canada clears way for $60bn Anglo Teck merger