Warren Buffett, the billionaire investor who’s retiring on the finish of 2025, has entertained and educated shareholders in his Berkshire Hathaway conglomerate for a few years together with his pithy annual letters outlining the agency’s efficiency.Yearly since 1965 he has up to date his buyers on the journey as Berkshire morphed from a “struggling northern textile enterprise” with $25m of shareholder fairness when he took over, to an empire price greater than $1tn.Right here we select a few of the choicest turns of phrase from the departing Sage of Omaha.For capital allocation, the world was his oysterLast yr, Buffett described his buy of Berkshire Hathaway as a mistake, writing:

Although the value I paid for Berkshire regarded low-cost, its enterprise – a big northern textile operation – was headed for extinction.

Cue Buffett’s capital allocation technique, although it took him some time to recognise that he and his crew confronted no institutional restraints when deploying capital; the one hurdle was their means to know the seemingly way forward for a doable acquisition.In 1982’s letter, Buffett defined that “what actually makes us dance” was the acquisition of 100% of excellent companies at affordable costs, which he conceded was an “terribly tough job”.Pay cashOne of the various classes Buffett discovered at his, and his buyers’, expense was to pay money – not shares – for acquisitions.A salutary incident on this studying curve was Buffett’s choice to pay 272,000 Berkshire shares to purchase the reinsurance firm Common Re in 1998, which he later mentioned was “a horrible mistake”, including:

My error brought about Berkshire shareholders to offer way over they acquired (a apply that – regardless of the biblical endorsement – is way from blessed when you find yourself shopping for companies).

Why a ‘bisexual’ strategy to investing pays offReaders of Buffett’s 1995 letter had been handled to a memorable clarification of his two-pronged funding technique – taking stakes in “fantastic” listed corporations whereas additionally making an attempt to purchase comparable companies of their entirety.This double-barrelled strategy gave an vital benefit over capital-allocators who caught to a single course, Buffett wrote, including:

Woody Allen as soon as defined why eclecticism works: ‘The actual benefit of being bisexual is that it doubles your possibilities for a date on Saturday evening.’

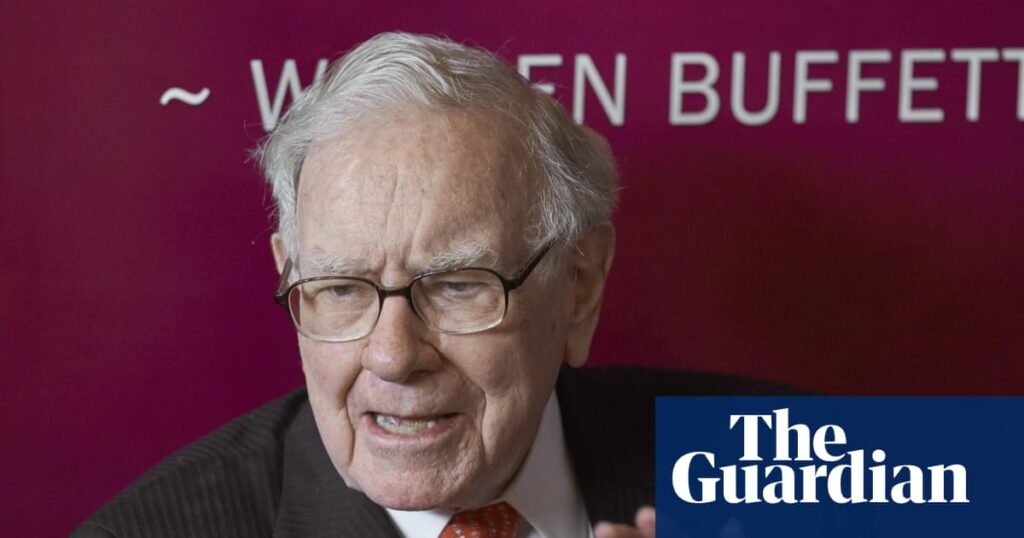

Buffett mentioned there would all the time be epidemics of worry and greed within the funding group. {Photograph}: Angela Weiss/AFP/Getty ImagesOn worry and greed …In 1986, Buffett coined his most well-known quote on investing: to be fearful when others are grasping and to be grasping solely when others are fearful.Admitting that he might see no shares that provided the “grand-slam residence run” alternative of being cheaply priced with good economics and good administration, Buffett mentioned there would all the time be epidemics of worry and greed within the funding group, although timing them was tough.On the perils of acquisitionsBuffett believes most offers do injury to the shareholders of the buying firm, and is baffled as to why potential consumers even take a look at projections ready by sellers.In 1994 he prompt many CEOs had been much less disciplined in how their spare capital was used, due to a “organic bias” in direction of “animal spirits and ego”.

When such a CEO is inspired by his advisers to make offers, he responds a lot as would a teenage boy who is inspired by his father to have a standard intercourse life. It’s not a push he wants.

When the tide goes out, you see who’s been swimming nakedBerkshire’s insurance coverage enterprise, Geico, has been the important thing to its growth over the a long time. Its float – cash from prospects that Berkshire holds till it’s wanted for payouts – sometimes comes at a really low value, and can be utilized to fund funding.Berkshire’s super-catastrophe (super-cat) insurance coverage enterprise has additionally been a worthwhile enterprise, though it confronted giant losses when catastrophe struck.In 1992, Hurricane Andrew value Berkshire $125m, roughly equal to its 1992 super-cat premium revenue. However different insurers got here out worse from what was then the biggest insured loss in historical past, as Buffett wrote:

Andrew destroyed a number of small insurers. Past that, it woke up some bigger corporations to the truth that their reinsurance safety towards catastrophes was removed from satisfactory. (It’s solely when the tide goes out that you simply study who’s been swimming bare.)

The risks of derivatives – weapons of mass destructionIn his 2002 letter, Buffett mentioned derivatives had been “time bombs, each for the events that deal in them and the financial system”. He warned:

In our view, nevertheless, derivatives are monetary weapons of mass destruction, carrying risks that, whereas now latent, are probably deadly.

That warning regarded very prescient in 2008, when the “horrifying internet of mutual dependence” that he mentioned “develops amongst enormous monetary establishments” helped to set off the monetary disaster. Buffett mentioned:

Individuals searching for to dodge troubles face the identical downside as somebody searching for to keep away from venereal illness: it’s not simply whom you sleep with, but in addition whom they’re sleeping with.

This “sleeping round” might truly be helpful for giant derivatives sellers as a result of it assured them authorities support if hassle hit, Buffett mentioned:

From this irritating actuality comes the primary legislation of company survival for formidable CEOs who pile on leverage and run giant and unfathomable derivatives books: modest incompetence merely received’t do; it’s mind-boggling screw-ups which can be required.

Nonetheless, that letter confirmed that Berkshire was a celebration to 251 derivatives contracts. Buffett justified this on the grounds that they had been all “mispriced at inception, typically dramatically so”.Be prepared for when it rains goldBuffett’s long-term aim is to outperform the S&P 500 index, which suggests preserving dry powder to deploy when valuations fall and “the money register will ring loud”.Buffett says his plan is to dream huge and be prepared for when darkish clouds fill the financial skies, as they may briefly rain gold. In 2016’s letter he promised:

When downpours of that kind happen, it’s crucial that we rush open air carrying washtubs, not teaspoons. And that we are going to do.

On delegation, and Buffett’s unimaginable managersBuffett has all the time been clear that the corporate is run on the precept of centralisation of economic choices at “the very prime”, which ends up in a number of delegation to the important thing managers operating every firm or enterprise unit.He favours older managers, joking that “you’ll be able to’t educate a brand new canine outdated tips”.Via the Nineteen Eighties, shareholders discovered of the “terrific” Rose Blumkin and her household. “Mrs B” had escaped Russia, based a furnishings retailer in Nebraska with $500, provided significantly better offers than rivals, and was producing greater than $100m of gross sales yearly out of 1 200,000 sq ft retailer earlier than promoting many of the enterprise to Buffett for $55m as she approached her 90s.Fortunately in 1993, shareholders discovered that Mrs B had celebrated her one hundredth birthday, with Buffett joking: “The candles value greater than the cake.” He added:

Naturally, I used to be delighted to attend Mrs B’s birthday celebration. In any case, she’s promised to attend my one hundredth.

Alas she wouldn’t. As Buffett reminisced in 2011:

She offered me our curiosity when she was 89 and labored till she was 103. (After retiring, she died the following yr, a sequence I level out to another Berkshire supervisor who even thinks of retiring.)

Succession planningBerkshire buyers had been handled to common hints about life after Buffett. From 2005, they had been reassured that the board had recognized a number of candidates who might tackle the position.Sounding unenthusiastic concerning the prospect, Buffett wrote in 2007’s letter:

The candidates are younger to middle-aged, well-to-do to wealthy, and all want to work for Berkshire for causes that transcend compensation.

(I’ve reluctantly discarded the notion of my persevering with to handle the portfolio after my dying – abandoning my hope to offer new which means to the time period ‘pondering exterior the field’.)

Subscribe to Updates

Get the latest creative news from FooBar about art, design and business.

Trending

- Minutes of latest Federal Reserve meeting reveal deep divide over interest rates | Federal Reserve

- ‘Data is control’: what we learned from a year investigating the Israeli military’s ties to big tech | Israel

- Channel tunnel train services suspended after power outage | Eurostar

- Private equity firms sell assets to themselves at a record rate

- ‘Be fearful when others are greedy’: Warren Buffett’s sharpest lessons in investing | Warren Buffett

- CineD 2025 Recap – Gear Highlights, Stories, and Insights from Our Team

- Little Spoon’s Caryn Wasser on the Reason Brand-Led Growth Beats Performance Marketing

- Japanese stocks surge to year-end record

‘Be fearful when others are greedy’: Warren Buffett’s sharpest lessons in investing | Warren Buffett

Related Posts

Add A Comment