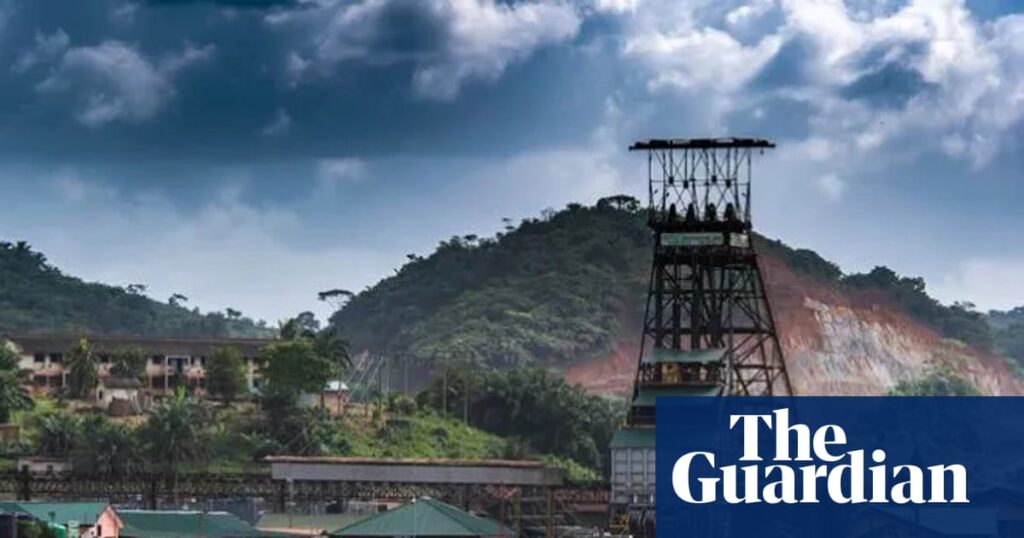

In late 2020, amid the financial maelstrom unleashed by Covid-19, there have been few higher locations to be than sitting on high of a goldmine.In Ghana, the west African nation as soon as known as the Gold Coast by British colonisers, the Bogoso-Prestea mine was producing 4,000 ounces of the dear steel a month, valued at $6m (£4.5m).As gold costs reached document highs, London-based Blue Worldwide Holdings – a seasoned investor in African vitality initiatives, pounced to purchase the mine for $95m.Blue Worldwide promised “engaging monetary returns whereas having a constructive affect on the communities and nations through which it operates, and the planet as a complete”, in response to its web site.mapIt loved the backing of a trio of British political heavyweights, together with two members of the Home of Lords and a authorities minister.But, a number of quick years later, its future seems to have tarnished.And, because the Guardian reveals now, the enterprise seems to have resulted in collateral harm to everybody from Ghanaian mineworkers to a member of the British royal household, a billionaire backer of the GB Information TV channel and, probably, UK taxpayers.Political heavyweights“Blue Gold is a rip-off” learn a placard, as protesters, backed by a brass band, voiced their discontent in February 2024.It was the most recent in a string of demonstrations as miners and suppliers within the resource-rich Ashanti gold belt demanded to know why they have been seeing no profit from the dear steel buried beneath their ft.4 years earlier, when Blue Worldwide arrived, the longer term had appeared promising.The corporate boasted a monitor document of African funding stretching again to 2011, steered by its co-founders Andrew Cavaghan and Mark Inexperienced, skilled buyers with monetary pedigree.In addition to its new goldmine in southern Ghana, the corporate additionally owned a promising hydroelectric energy venture in Sierra Leone, a partnership with the federal government in Freetown.It got here with a phalanx of status backers, drawn from the British political and enterprise elite.Lord Dannatt, a former head of the British military, served on Blue Worldwide’s advisory board. {Photograph}: Murdo Macleod/The GuardianLord Dannatt, the previous head of the British military, and Lord Triesman, a Overseas Workplace minister with duty for UK diplomatic relations in Africa, served on its advisory board.So, too, did Philip Inexperienced, who was rebuilding his status after the implosion of the federal government outsourcer Carillion, which collapsed throughout his time as chair in 2018.John Glen, a Treasury minister between 2018 and 2023, held shares within the firm.The UK taxpayer was additionally considerably uncovered. In early 2024, it emerged that the Treasury had lent Blue Worldwide £3.3m of taxpayers’ cash through the “Future Fund” the earlier 12 months.Lord Triesman was additionally a member of Blue Worldwide’s advisory board. {Photograph}: Roger Harris/UK ParliamentGlen, the MP for Salisbury in Wiltshire, mentioned he was not conscious of the mortgage software when he served on the Treasury and there’s no suggestion that he did.The Future Fund was designed, within the phrases of then chancellor Rishi Sunak, to assist “start-ups and progressive corporations” survive the pandemic by extending them loans that transformed into fairness.On this case, the cash supported an organization engaged in extracting priceless minerals from African soil.Idiot’s goldIn mining, all can seem calm on the floor, at the same time as issues crumble beneath floor.By the point British taxpayers’ cash was pumped into Blue Worldwide, its Ghanaian enterprise was on the point of a monetary collapse whose tremors reached from rural west Africa to the Metropolis of London.Inside two years of Blue Worldwide’s takeover, operations at Bogoso-Prestea had been shut down a number of occasions, in response to company filings and modern stories.Mineworkers blamed lack of funding from Blue, which owned and operated the mine through an area subsidiary, Future World Sources (FGR).Lack of output choked off cashflow and elevated prices, as tools failed or required upkeep, in response to one company submitting.FGR didn’t pay native suppliers, together with the Ghanaian state electrical energy firm, whereas mineworkers have been not noted of pocket, in response to filings, fuelling native protests.“It had devastating penalties,” mentioned Abdul-Moomin Gbana, the final secretary of the Ghana Mineworkers’ Union (GMWU). He mentioned staff’ salaries went unpaid for months, hitting the group laborious.“Basic situations declined as a result of they’d no revenue. The communities just about grew to become ghost cities,” he mentioned.“It grew to become apparent that if nothing was executed, there was no manner there could possibly be a future for the mine.”Blue Gold declined to reply questions concerning the claims of unpaid wages, and directed inquiries to FGR. FGR didn’t reply to requests for remark.Finally, in 2024, the Ghanaian authorities issued an ultimatum. Blue Worldwide should restore the mine to working manufacturing or hand again its lease, the appropriate to personal and function the location.The corporate tried to situation bonds – a type of IOU – in Ghana to boost money that could possibly be invested in bringing the mine again to manufacturing however the fundraising effort stalled.The administrators behind Blue Worldwide, Cavaghan and Inexperienced, restructured the debt-laden mine’s possession, shifting it into a brand new entity known as Blue Gold, additionally owned and included by them, as a part of a plan to boost new funding within the US.Regardless of this, in late 2024, the federal government of Ghana made good on its risk to grab again the Bogoso-Prestea lease.skip previous publication promotionSign as much as Enterprise TodayGet set for the working day – we’ll level you to all of the enterprise information and evaluation you want each morningPrivacy Discover: Newsletters could comprise data about charities, on-line adverts, and content material funded by exterior events. For extra data see our Privateness Coverage. We use Google reCaptcha to guard our web site and the Google Privateness Coverage and Phrases of Service apply.after publication promotionA authorized problem from the corporate failed earlier this 12 months in Ghana’s excessive courtroom and the mine was handed over to a brand new operator.From Iraq to GhanaBlue Worldwide’s travails weren’t felt solely by Ghanaian miners and the encompassing group.The British taxpayer’s funding within the enterprise now gave the impression to be beneath risk too. But it surely was blue-blooded lenders that suffered the extra profound penalties.In 2021, firstly of its Ghanaian enterprise, Blue Worldwide had borrowed about $5m from Devonport Capital, a bespoke lender specialising in “high-risk” jurisdictions, providing short-term loans at comparatively excessive rates of interest.John Glen, a Treasury minister between 2018 and 2023, held shares in Blue Worldwide. {Photograph}: Dan Kitwood/Getty ImagesDevonport, headquartered in Plymouth, was based by Paul Bailey, a company lawyer who had carved out a distinct segment advising buyers in postwar Iraq. His companion was Thomas Kingston, who had additionally labored in Iraq conducting hostage negotiations for the UK Overseas Workplace in Baghdad, the place he had witnessed first-hand the horrors of sectarian violence.Within the UK, Kingston was higher identified for his marriage, in 2019, to Girl Gabriella Windsor, a second cousin of King Charles III.With this skilled and well-connected duo on the helm, Devonport thrived, recording pre-tax revenue of £6m in 2023.However as Blue Worldwide’s Ghanaian woes mounted, it started defaulting on the curiosity funds it owed to Devonport.One other of Devonport’s essential debtors additionally defaulted on the similar time, leaving the lender more and more unable to repay its personal collectors.Then, in February 2024, private tragedy struck.Thomas Kingston died from a gunshot wound at his mother and father’ house within the Cotswolds on 25 February. A coroner dominated that he had taken his personal life.Torn aside by a mix of non-public tragedy and the continuing incapacity to recuperate its money owed, Devonport fell into administration a 12 months later.A report revealed in March by the administrator, RG Insolvency, lists collectors who had lent cash to Devonport.Legatum Group founder Christopher Chandler had lent cash to Devonport. {Photograph}: Afolabi Sotunde/ReutersAmong them is Christopher Chandler, a New Zealand businessman and founding father of Dubai-based funding firm Legatum, which funds UK media channel GB Information. Chandler declined to remark.Collectors additionally embody HM Income and Customs, which is owed greater than £788,000.RG Insolvency estimates that, of the £49m owed to Devonport, as little as £11.2m could possibly be recovered.A lot will depend upon whether or not directors can recoup about £13.5m owed by Blue Worldwide.Earlier this 12 months, the staff behind Blue Worldwide accomplished a $114.5m mixture with a US “clean cheque” funding agency known as Notion Capital, and floating the mixed entity on the US Nasdaq inventory alternate beneath the Blue Gold title.Golden future?What comes subsequent is murky at greatest. Blue Gold’s new web site outlines formidable plans to reopen the Bogoso-Prestea mine.However Ghana seems to be sticking by its resolution to strip Blue of the lease.The dispute is now the topic of worldwide arbitration, in response to a inventory market submitting by Blue Gold, leaving the mine’s future up within the air. In an annual report filed within the US, Blue Gold admits that the leases could by no means be returned, which would cut back the worth of the corporate’s belongings from $368m to lower than $45m.A bit on the corporate web site affords little additional readability, stating: “Topic to resolving authorized dispute with the federal government of Ghana, first gold pour is predicted.”The Guardian approached the Overseas Workplace to ask if the UK authorities had intervened on Blue Gold’s behalf with ministers in Accra. The division declined to remark.Dannatt and Triesman additionally declined to remark. Glen mentioned he had not mentioned the corporate’s Ghanaian dispute with any UK authorities division, official or diplomat.On the bottom in Ghana,native sources say little has modified, with operations nonetheless shut down beneath a brand new proprietor and mineworkers nonetheless left unpaid.The uncertainty signifies that, for everybody from native mineworkers to members of the British institution, the dream of blue gold stays a mirage, tantalisingly out of attain.The Guardian approached Blue Gold for remark. The corporate referred the Guardian to its web site and shareholder filings however didn’t tackle questions instantly.Paul Bailey didn’t return requests for remark. RG Insolvency declined to remark.

Trending

- ‘It’s not a coincidence’: journalists of color on being laid off amid Trump’s anti-DEI push | US news

- UK can ‘lead the world’ on crypto, says City minister

- Spain’s commitment to renewable energy may be in doubt

- Whisky industry faces a bleak mid-winter as tariffs bite and exports stall

- Hollywood panics as Paramount-Netflix battle for Warner Bros

- Deal or no deal? The inside story of the battle for Warner Bros | Donald Trump

- ‘A very hostile climate for workers’: US labor movement struggles under Trump | US unions

- Brixton Soup Kitchen prepares for busy Christmas