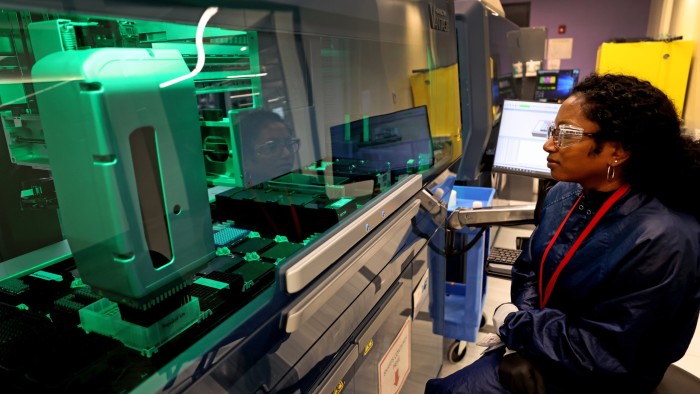

The reside music, free drinks and dancing at an enormous Boston biotech convention in June belied a stark actuality: the town’s biotech sector is in bother.Whereas some industries are nonetheless languishing because the Federal Reserve started elevating rates of interest in 2022, few have been hit as laborious because the biotech sector by Trump administration insurance policies. Considerations about routine drugs approvals from the US Meals and Drug Administration have frightened buyers. The White Home’s requires decrease drug costs have chilled deal exercise to date this yr. President Donald Trump’s assaults on Harvard College have included freezing federal analysis grants, posing a long-term menace to biotech.Altogether, the Trump “coverage uncertainty has resulted in important turmoil and operational modifications at biopharma corporations”, Morgan Stanley stated in a June report.In the meantime, the shortage of investor urge for food for brand new points has closed the door for a lot of biotechs ready to go public. Usually, the biotech sector produces no less than a dozen preliminary public choices a yr. However not too long ago, “public [biotech] corporations have gotten crushed”, stated Dan Gold, president of Fairway Consulting Group, which does biotech recruiting. “There isn’t a exit for enterprise folks after they put of their cash now.”“We are literally seeing corporations shut, which is new,” Gold stated. “I’ve not seen closures at this quantity ever.” Trainees be taught correct process to enter a cleanroom at Northeastern College’s biopharmaceutical evaluation and coaching laboratory © Craig F Walker/The Boston Globe/Getty ImagesFor the primary six months of the yr, the variety of biotech IPOs sank to its lowest stage since 2012, in response to Renaissance Capital. Enterprise capital corporations introduced no biotech corporations to an IPO for the primary time since 2011, Renaissance stated.“It’s a very powerful surroundings,” stated Matthew Kennedy at Renaissance. “At this level, most of the biotechs themselves could be reluctant to maneuver ahead understanding they may have a tough time promoting the deal.”Vaccine-maker Moderna, which is headquartered on the north facet of Boston’s Charles River, has seen its share value sink 27 per cent this yr. The corporate, a top-20 employer in Boston’s Cambridge neighbourhood, is likely one of the worst performers within the S&P 500 this yr. A 15 minute drive to the north, bluebird bio, which was a $10bn biotech firm in 2018, was offered earlier this yr for lower than $50mn. Vor Biopharma, which relies three subway stops from Harvard College, stated in Might it might lay off most of its employees.“What we’re seeing in private and non-private markets is numerous corporations which can be truly folding,” Marian Nakada, a vice-president at Johnson & Johnson’s enterprise division, stated on the convention. In June, Vor introduced a $175mn fundraising as a part of a licence settlement with a Chinese language biotech firm, however a Vor spokeswoman stated the lay-offs have been nonetheless continuing.The headquarters of bluebird bio in Cambridge, Massachusetts. It was valued at $10bn in 2018 © Kristoffer Tripplaar/AlamyBoston’s small biotech corporations have powered the regional financial system. Healthcare is Boston’s largest employment sector. Healthcare and social help jobs comprise 22 per cent of the town’s workforce, properly above the 14 per cent nationwide common, in response to authorities statistics.Boston has loved a symbiotic relationship between the federal authorities and native universities — one which has been crippled by authorities funding cuts. The Nationwide Institutes of Well being has halted grants to Harvard and different universities, hitting a fertile floor for biotech growth.Offers in biotech which can be getting carried out are underneath stress from Washington. Verve Therapeutics, which relies a brief stroll from Boston’s well-known Fenway Park baseball area, was acquired by Eli Lilly in June for $1.3bn. However the deal was prompted partly by the uncertainty following the resignation of a prime FDA official, Verve stated in a June 25 regulatory submitting. The corporate stated its share value plunged after Peter Marks stop, elevating considerations that FDA approvals could possibly be delayed.“The declining regulatory panorama for biopharmaceutical corporations” had made elevating money “much more tough”, Verve stated.Nurses making ready doses of the Moderna Covid-19 vaccine at a facility in Boston through the pandemic © Jessica Rinaldi/The Boston Globe/Getty ImagesEarlier in June, KalVista Prescribed drugs, which is headquartered on the Charles River, stated the FDA missed a regulatory deadline for one among its drug approvals. The delay was “resulting from heavy workload and restricted sources” on the company, KalVista stated. An organization spokeswoman declined to remark past its regulatory filings.Boston’s June biotech convention was hosted by the Biotechnology Innovation Group, the sector’s largest lobbying group. To counter Trump’s insurance policies, the organisation has elevated its lobbying this yr by hiring former Republican senator Richard Burr, who sponsored the FDA Modernization Act of 1997.On the convention, FDA commissioner Marty Makary stated the company’s “morale is sweet and bettering”.However Gold at Fairway Consulting Group stated he was having conversations virtually each week with FDA staff in search of new jobs. “I feel the morale is terrible there from what I’m listening to.”Moderna’s headquarters. It’s a top-20 employer in Boston’s Cambridge neighbourhood © David L Ryan/The Boston Globe/Getty ImagesMorale can be struggling at Harvard, Cambridge’s largest employer. Promising biotech science that begins at such universities might be spun out into impartial corporations. Boston’s Beam Therapeutics, for instance, was co-founded by Harvard professor David Liu. Beam has a licence settlement with Harvard and has paid the college $15mn because the firm’s IPO.“I undoubtedly have long-term considerations in regards to the trajectory of funding within the US and the soundness of our science ecosystem,” Beam’s chief government John Evans stated in an interview.

Trending

- ARRI Reaffirms Commitment to Lighting and Camera Systems – Full Roadmap for 2026, Munich Consolidation Underway

- Brussels to give carmakers breathing space on 2030 climate targets

- Canada clears way for $60bn Anglo Teck merger

- UK and South Korea strike trade deal

- Runway announces its AI general world model GWM-1

- UK unemployment rate rises slightly to 5.1%

- Juventus bid battle brings a new meaning to ‘crypto vs fiat’

- Thousands of drivers wrongly fined for speeding since 2021