Money App launched a brand new peer-to-peer cost characteristic on Tuesday referred to as “Swimming pools” that enables customers to pool cash with mates or relations to pay for bills like grocery payments, restaurant checks, holidays, and group items. Initially out there to pick out customers, it’ll increase extra broadly within the coming months.

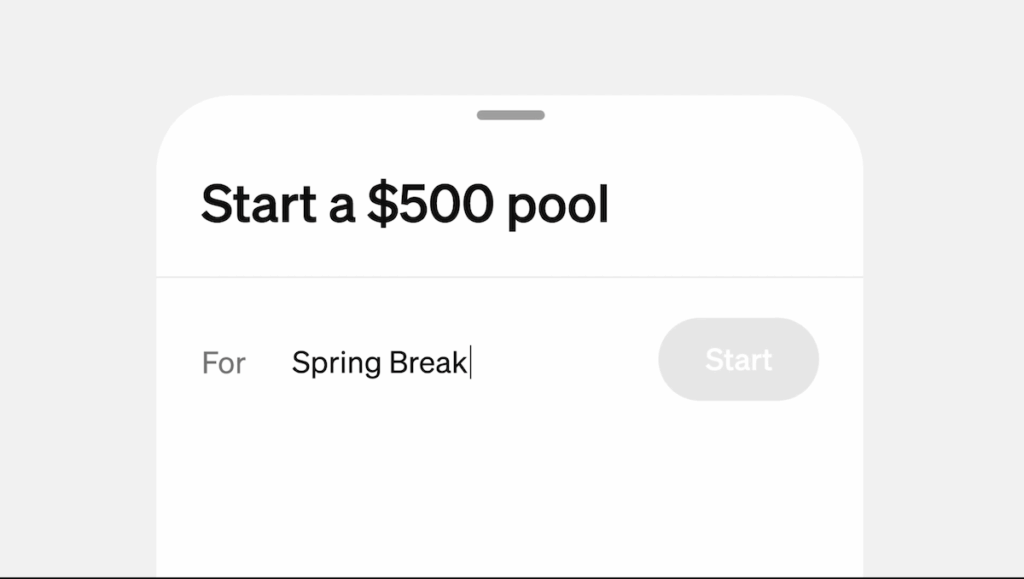

Customers can create Swimming pools via the cost tab by setting a goal quantity and welcoming contributors by way of their $cashtag or texting a hyperlink to non-users to pay via Apple Pay or Google Pay.

The organizer can shut the pool anytime and switch the funds to their Money stability.

The power for non-users to contribute via Apple Pay and Google Pay is especially vital, because it encourages participation from these not on the app. The platform wants development after reporting that buyers used the app lower than anticipated, resulting in a first-quarter gross revenue that fell in need of its projections.

This transfer comes as Money App seeks to compete with Venmo and PayPal, which each supply money-pooling capabilities.