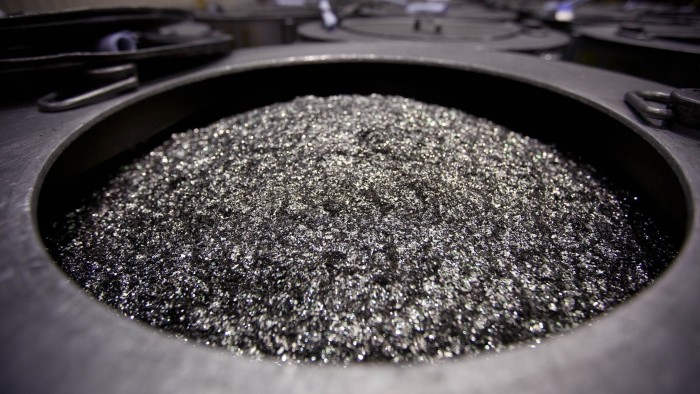

Unlock the Editor’s Digest for freeRoula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.The author is the writer of ‘Chip Struggle’ and adviser to Vulcan ElementsShortly after Beijing introduced new restrictions on exporting uncommon earth minerals and the specialised magnets they make, the world’s auto business warned of shortages that might drive manufacturing facility closures. China’s skilful deployment of uncommon earth sanctions this spring was most likely the important thing consider forcing Washington to reverse its tariff rises on the nation. They symbolize a brand new period of Chinese language financial statecraft — proof of a sanctions coverage able to pressuring not solely small neighbours but additionally the world’s largest financial system.China has been a prolific consumer of financial sanctions lately, however lots of its efforts have been blunt and solely partially efficient. Punitive measures have usually been hidden and even formally denied. Chinese language tour teams misplaced curiosity in visiting the Philippines, we had been informed; whereas Taiwanese pineapples couldn’t meet well being requirements and Chinese language customers merely didn’t need to purchase Korean merchandise.Authorities-backed boycotts have imposed financial prices on China’s commerce companions, however their document at reaching political objectives has been blended. They appear to have prevented some international locations from internet hosting the Dalai Lama or difficult Beijing’s nine-dash line within the South China Sea. But they’ve proved much less impactful when core nationwide pursuits are at stake.Australia didn’t cave when China lower wine purchases over international coverage disputes, for instance. Nor did South Korea take away a missile defence system it put in in 2016, regardless of China imposing sanctions and demanding its withdrawal. And China’s earlier sanctions in opposition to the US — together with blacklisting defence firms and imposing licensing regimes on sure mineral exports — have been extra political sign than financial substance.The brand new controls on exporting uncommon earth supplies and magnets are totally different. In only a handful of weeks they threatened to shutter key factories throughout the auto business — the biggest manufacturing sector in most superior economies. In addition they introduced the US president to heel on his signature initiative: the commerce battle.The White Home thought it had achieved escalation dominance. Its concept was that sky excessive tariffs could be so pricey that Beijing would don’t have any hope however to barter. Actually, China’s leaders might swallow the political price of tariffs. However Washington couldn’t ignore the lack of uncommon earth supplies and its affect on auto firms.Why did these sanctions show a lot simpler than prior efforts? Partly as a result of Beijing has been bettering its toolkit, constructing a authorized regime to chop strategic exports and enhance information of commerce companions’ ache factors. China has even made this extraterritorial, demanding that firms in different international locations not use Chinese language minerals to make merchandise for the US defence business. Beijing wager that different main buying and selling companions wouldn’t blame it for the uncommon earth restrictions however as a substitute push Washington to roll again tariffs.Certainly, since April, Chinese language exports of uncommon earth minerals and magnets have fallen not solely to the US, however to different main buying and selling companions equivalent to Japan and South Korea. Indian automakers have lower manufacturing within the face of supplies shortages. European Fee president Ursula von der Leyen introduced a uncommon earth magnet to the June G7 assembly to name for extra non-China manufacturing. The EU is prioritising uncommon earth exports in its diplomacy with China.This broad world affect means that China’s means to exactly goal uncommon earth restrictions should be restricted. It’s tougher to limit resale of commodities like uncommon earth oxides than, say, jet engines or chipmaking gear. If China wished solely to chop uncommon earth supplies from reaching the US it’d wrestle to take action. Corporations in different international locations might proceed to quietly promote to American clients. Nonetheless, probably the most putting facet of China’s weaponisation of uncommon earths is how unprepared western governments and firms had been. Even those that can’t title a single uncommon earth component know that China dominates their manufacturing. Nonetheless, over the last decade and a half since China first lower uncommon earth exports to Japan in 2011, the west has failed to seek out new suppliers. Some modest steps had been taken. Korea expanded its stockpiles. Japan invested in Australian mines. But most western governments devised important minerals methods after which selected to not fund them. Producers communicate of resilience but some maintain solely every week’s provide of uncommon earth magnets of their inventories. This can be a weapon they’ve been watching for many years. They need to not have been shocked when Beijing lastly pulled the set off.

Trending

- UK inflation dips by more than expected to 3.2%

- Tech Exchange

- The Deals That Made 2025 a Landmark Year for Ad and Media M&A

- Monzo shareholders push to oust chair in revolt over CEO’s exit

- Weight-loss injection ad banned for targeting new mums

- Warner Bros to reject $108bn Paramount bid, reports say

- All Networks Up Double-Digits in Primetime

- New £150m funding package to protect jobs at Grangemouth