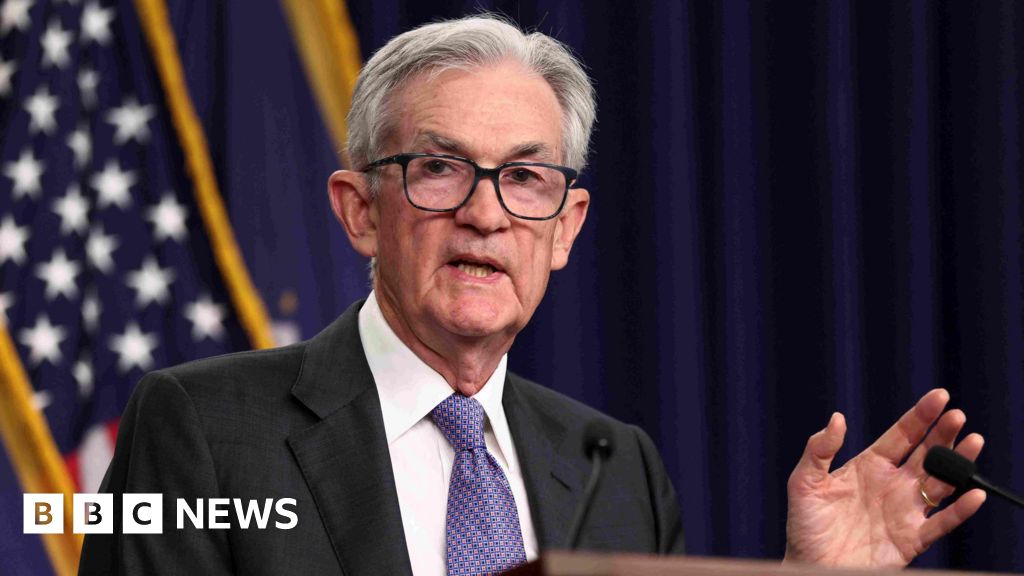

Danielle KayeBusiness reporterReutersUS Federal Reserve Chair Jerome PowellThe US Federal Reserve has lowered rates of interest for the third time this 12 months, at the same time as inside divisions create uncertainty about extra cuts within the coming months.The central financial institution stated on Wednesday it was decreasing the goal for its key lending price by 0.25 proportion factors, placing it in a variety of three.50% to three.75% – its lowest degree in three years.However policymakers disagree about how the Fed ought to steadiness competing priorities: a weakening job market on the one hand, and rising costs on the opposite.The Fed’s financial projections launched on Wednesday counsel one price reduce will happen subsequent 12 months, though new information may change this.Fed chair Jerome Powell stated central bankers want time to see how the Fed’s three cuts this 12 months work their manner via the US economic system. Policymakers will intently look at incoming information main as much as Fed’s subsequent assembly in January, he added.”We’re well-positioned to attend to see how the economic system evolves,” Powell instructed reporters.These hoping for rates of interest to maintain coming down, together with President Donald Trump, may need to attend.The Fed is going through a “very difficult state of affairs” because it confronts dangers of rising inflation and unemployment, Powell stated, including: “you may’t do two issues without delay”.The choice to decrease charges on Wednesday was not unanimous, suggesting widening divisions amongst central bankers over the outlook for the US economic system. Three Fed officers broke ranks and formally dissented.Stephen Miran, who’s on depart from his publish main Trump’s Council of Financial Advisers, voted for a bigger 0.5 proportion level reduce. Austan Goolsbee, president of the Federal Reserve Financial institution of Chicago, and Jeffrey Schmid, president of the Federal Reserve Financial institution of Kansas Metropolis, voted to carry charges regular.Trump, who has repeatedly urged Powell to decrease charges, stated after the assembly on Wednesday that the Fed’s reduce may have been “a minimum of doubled”.”Our charges ought to be a lot decrease,” he stated at a roundtable on the White Home. “We should always have the bottom charges on the earth.”A knowledge blackout through the longest-ever US authorities shutdown, which resulted in November, has left policymakers partially at nighttime in regards to the state of the economic system. However issues a couple of slowing job market proceed to outweigh inflation fears, a minimum of for now.The unemployment price ticked up from 4.3% to 4.4% in September, Labor Division figures confirmed in a delayed report launched final month. Reducing rates of interest is aimed toward stimulating the job market by creating decrease borrowing prices for companies.Fears about tariff-driven inflation had taken centre stage earlier this 12 months when Trump pushed ahead with sweeping tariffs on most of the nation’s largest buying and selling companions.Inflation continues to be above the Fed’s 2% goal. In September, it hit 3% for the primary time since January.However whereas tariffs look like boosting some shopper costs, latest milder-than-expected inflation readings have allowed the Fed to concentrate on boosting the labour market by decreasing charges, analysts stated.Dissents and disagreementsStill, policymakers stay divided over the trail ahead for rates of interest.Requested about disagreement amongst policymakers, Powell acknowledged that it is “uncommon” to have “persistent pressure” between the Fed’s two mandates to maintain costs steady and unemployment low.”And whenever you do, that is what you see,” he stated, referring to rising divisions.Nonetheless, Powell characterised the interior debate between Fed officers as considerate and respectful.”We come collectively and we attain a spot the place we will decide,” he stated.The central financial institution’s so-called dot plot, a quarterly nameless financial forecast, confirmed on Wednesday a median expectation for one extra 0.25 proportion level reduce in 2026. That prediction was unchanged from the earlier dot plot in September.Central bankers are poised to have a bit extra readability subsequent week, with the anticipated launch of official information on the labour market and inflation for November.The incoming information may shift policymakers’ outlook, probably bolstering requires additional easing subsequent 12 months if there are new indicators that the job market is stalling.Who will succeed Powell?Trump’s seek for Powell’s alternative as Fed chair, as soon as his time period ends subsequent Could, is including to uncertainty in regards to the path ahead for Fed coverage.Trump may announce his choose as quickly as inside the subsequent few weeks.Kevin Hassett, a long-time conservative economist and key Trump financial adviser, is seen because the front-runner to succeed Powell.A Trump loyalist, Hassett served as chair of the White Home Council of Financial Advisers throughout Trump’s first time period and now leads the Nationwide Financial Council. He has been a stalwart defender of Trump’s financial insurance policies, downplaying information displaying indicators of weak point within the US economic system, doubling down on allegations of bias on the Bureau of Labor Statistics and backing Trump’s dealing with of the Fed.Hassett’s allegiance to the president has drawn questions from analysts about whether or not he would act independently and the way a lot sway he would have with different members of the board.Different names which were floated for the Fed chair embrace economist Kevin Warsh, present Fed Governor Christopher Waller and even Treasury Secretary Scott Bessent.Trump is “nonetheless making up his thoughts, and he is searching for somebody who can be in his mind-set,” Thomas Hoenig, a distinguished senior fellow on the Mercatus Middle, instructed the BBC.The candidates, he added, “should undertaking that they are going to be impartial, or the markets will turn into fairly nervous – and that can create extra volatility”.Requested on Wednesday whether or not Trump’s seek for a brand new Fed chair is hindering his job or altering his considering, Powell responded with a powerful “no”.

Trending

- Whisky industry faces a bleak mid-winter as tariffs bite and exports stall

- Hollywood panics as Paramount-Netflix battle for Warner Bros

- Deal or no deal? The inside story of the battle for Warner Bros | Donald Trump

- ‘A very hostile climate for workers’: US labor movement struggles under Trump | US unions

- Brixton Soup Kitchen prepares for busy Christmas

- Croda and the story of Lorenzo’s oil as firm marks centenary

- Train timetable revamp takes effect with more services promised

- Swiss dealmaking surges to record highs despite strong franc