Is there a approach that Intel might be saved? Former Intel chief govt Craig Barrett thinks so, and it isn’t the way in which the corporate’s former board members counsel.

Intel ought to have a lot of its prospects make investments a complete of $40 billion within the firm to make sure a gentle provide of chips, the corporate’s former chief govt wrote over the weekend.

Barrett’s feedback come as present chief govt Lip-Bu Tan is scheduled to fulfill with President Trump on Monday on the White Home, in line with a report. Nevertheless, the assembly doesn’t seem on Trump’s public calendar.

Intel faces quite a few crises. On one hand, the corporate has already introduced the layoffs of hundreds of workers, relationship again to final 12 months. Though Intel solicited billions from the U.S. authorities as a part of the CHIPS Act, it has warned that it would exit chip manufacturing altogether if it could’t discover a buyer for its 14A manufacturing course of. The 14A course of follows the 18A course of, the inspiration of Panther Lake, which Tan has mentioned stays on observe. However Trump has additionally demanded that Tan step down, citing Tan’s ties to a lot of Chinese language corporations in his function as a enterprise capitalist.

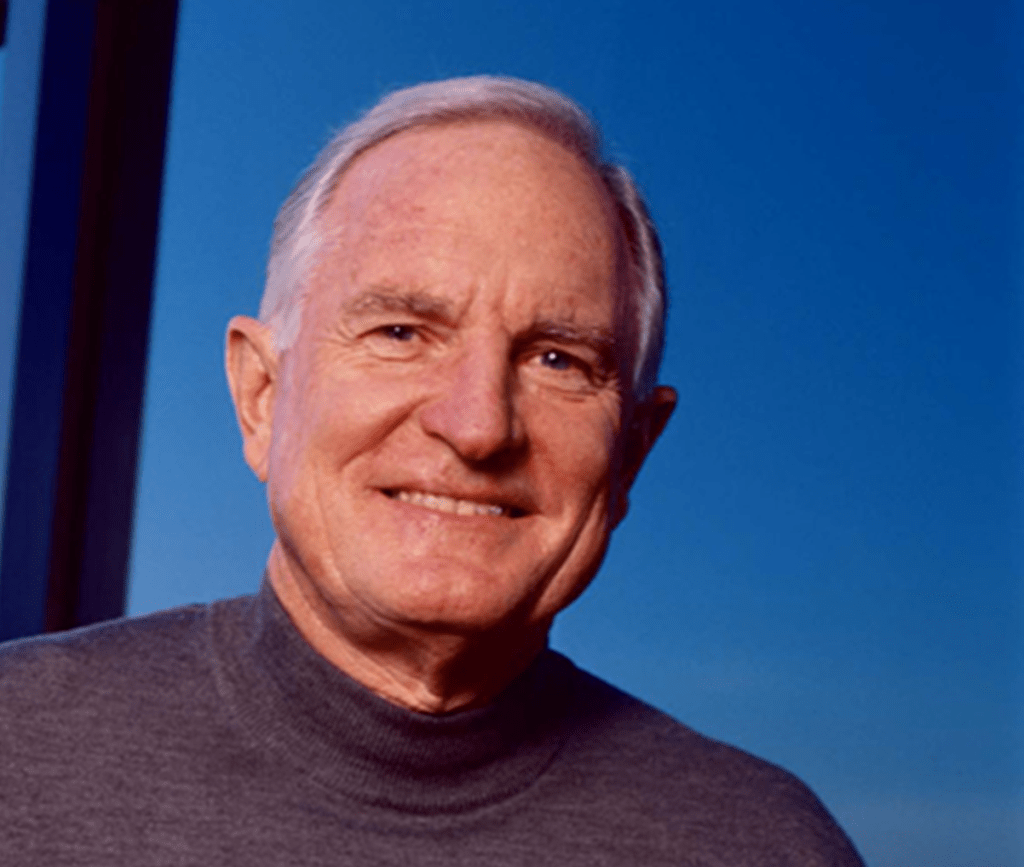

Within the interim, former Intel chief govt Craig Barrett has weighed in with an inventory of bombastic ideas on the matter. Barrett, writing in Fortune, is the 86-year-old former CEO who took the reins at Intel in 1998, succeeding the long-lasting Andy Grove. Barrett oversaw the Pentium III and Pentium 4, in addition to the early days of the Xeon processor.

An funding into the longer term

In Barrett’s thoughts, prospects must be investing in Intel to make sure a secure (and American) provide of semiconductors. “Neither Samsung or TSMC plan to carry their cutting-edge manufacturing to the U.S. within the close to time period,” he wrote. “U.S. prospects like Nvidia, Apple, Google, and so on. wants and will perceive they NEED a second supply for his or her lead product manufacturing because of pricing, geographic stability and provide line safety causes.”

Barrett steered that Intel’s prospects make investments a “aggressive” $40 billion into the corporate.

“The place does the cash come from? The purchasers make investments for a bit of Intel and assured provide,” Barrett wrote. “Why ought to they make investments? Home provide, second supply, nationwide safety, leverage in negotiating with TSMC, and so on. AND IF THE USG GETS ITS ACT TOGETHER, they catalyze the motion with a 50% (or no matter quantity Trump picks) tariff on cutting-edge semi imports. If we are able to help home metal and aluminum, certainly we are able to help home semiconductors.” (Emphasis Barrett’s.)

Fortune, which has apparently dug into its contact listing to solicit recommendation on the Intel matter, beforehand printed an opinion written by former board members arguing that Tan must be fired and the corporate damaged up. “Be severe,” Barrett wrote.

“By all means, if you wish to complicate the issue, then take the time to separate up Intel and make the FFWBMs [the “four former wise board members”] comfortable however if you happen to’re within the enterprise of saving Intel and its core manufacturing energy for the USA then remedy the actual drawback — rapid funding in Intel, dedicated prospects, nationwide safety, and so on.