Dwelling

Day by day Information

Good points from litigation funding could be taxed…

Laws & Lobbying

Good points from litigation funding could be taxed at almost 32% in newest Senate model of price range megabill

By Debra Cassens Weiss

June 30, 2025, 3:19 pm CDT

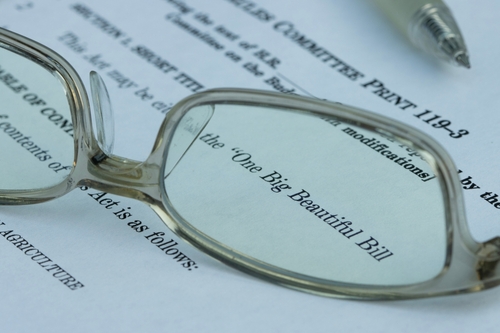

The U.S. Senate’s model of a price range megabill, referred to as the One Huge Stunning Invoice Act, launched Saturday units a proposed tax of 31.8% on earnings from litigation finance contracts, down from 40.8% within the first model of the invoice. (Photograph from Shutterstock)

The U.S. Senate’s model of a price range megabill, referred to as the One Huge Stunning Invoice Act, launched Saturday units a proposed tax of 31.8% on earnings from litigation finance contracts, down from 40.8% within the first model of the invoice.

The tax could be imposed on realized positive factors from litigation funding preparations, in accordance with tales by Forbes and Law360 written when the proposed tax was at 40.8%. Litigation funders wouldn’t have the ability to offset positive factors with losses, in accordance with Bloomberg Regulation, which reported on the brand new proposed tax fee.

“That is an excise tax on capital positive factors or funding revenue, and it’s unprecedented,” wrote Anthony J. Sebok, a professor at Yeshiva College’s Benjamin N. Cardozo College of Regulation, within the Law360 article. “Usually, a enterprise—no matter whether or not it makes cash from investing in pork bellies or esoteric monetary devices—isn’t taxed on every transaction it makes however on its web earnings.”

The company tax fee is a a lot smaller 21%, Sebok mentioned.

Gregg Polsky, a professor on the New York College College of Regulation, commented on the earlier 40.8% proposal in a June 23 story by Law360. He mentioned the proposal “might characterize a sea change in the best way the tax code is used.”

“We actually haven’t seen the tax code be weaponized to destroy a distinct segment trade like this earlier than,” Polsky mentioned. “It’s fully unprecedented.”

Paul Kong, the manager director of the Worldwide Authorized Finance Affiliation, advised Bloomberg Regulation that the group isn’t glad with even the decrease tax fee.

“This provision is clearly meant to focus on our trade and shut down company accountability, and fidgeting with the tax fee doesn’t change that,” Kong mentioned.

Write a letter to the editor, share a narrative tip or replace, or report an error.