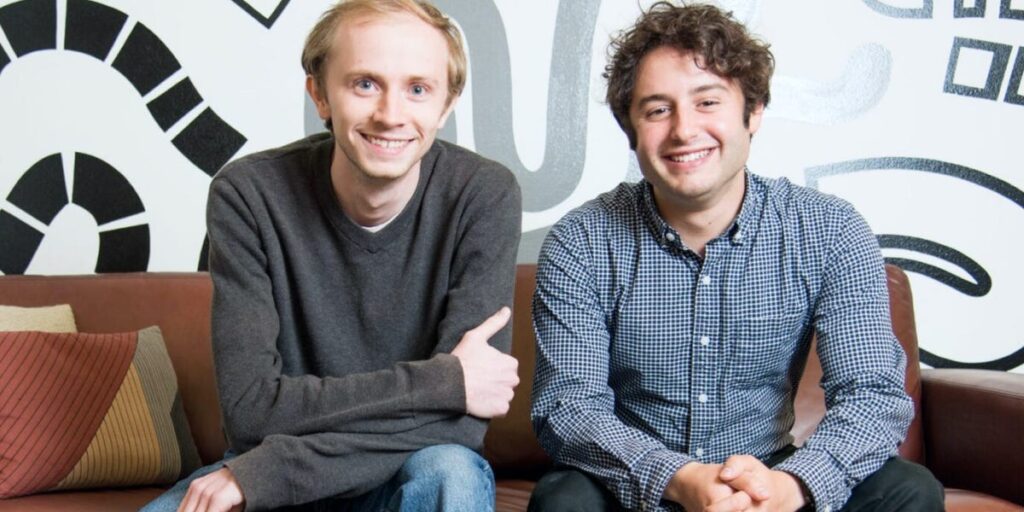

When Figma went public on the finish of July, it marked a revival within the tech IPO market after a three-year lull.However Terrence Rohan, an early investor in Figma and its first board director, noticed the corporate’s potential nicely earlier than its blockbuster debut.”I feel you might have very simply written an MBA-style case examine on why Figma would not work,” he informed Enterprise Insider. The market appeared too small, the competitors too intense, and the margins unworkable, Rohan mentioned. There have been many causes to doubt its success.Rohan, nevertheless, mentioned he noticed potential in its founders, Dylan Discipline and Evan Wallace.”Dylan and Evan had been simply distinctive, they usually had a imaginative and prescient for the longer term,” he mentioned of the cofounders whom he first met throughout their seed pitch in 2013 when he was an investor at Index Ventures.Index led Figma’s $3.87 million seed spherical and continued backing the corporate by means of a number of funding rounds, in response to PitchBook. Rohan served as Figma’s first board director from 2013 to 2015. He is not on the board, however stays on the corporate’s cap desk. He attended their IPO celebration on the New York Inventory Alternate and nonetheless retains in contact with Discipline, who’s now CEO.Figma is a digital design software that enables individuals to create and collaborate on inventive initiatives, together with web sites, apps, and logos. When it launched its first software in 2015, the thought of real-time, collaborative on-line design was seen as “heresy,” Discipline wrote in a put up on Figma’s web site in 2020.”It was a generational assault on top-down, siloed fashions of decision-making and a problem to the id of many designers,” he mentioned. Some within the subject even informed him, “If this was the way forward for design, they had been altering careers.”

Associated tales

Enterprise Insider tells the revolutionary tales you need to know

Enterprise Insider tells the revolutionary tales you need to know

By 2022, it had constructed a base of greater than 4 million customers. That is when it attracted the eye of Adobe, which introduced plans to amass the corporate. However after regulatory stress, the $20 billion deal collapsed.When Figma lastly went public final month, the providing was greater than 40 instances oversubscribed, and the inventory greater than tripled its IPO value on the primary day of buying and selling.Wanting again, Rohan mentioned it was Discipline and Wallace’s authenticity and their sense of self that first gained him over. These have turn out to be a few of the high traits he seems for in founders when he is contemplating investing.”There’s all the time, like, an extended type of story to what they’re constructing, or the talent units that they are utilizing — but it surely simply suits them,” he mentioned. “One other factor that’s inside that idea of authenticity is a way of self-awareness.” These are founders who know “who they’re, they usually know what they’re good at, they usually know what they should construct.”Previously a number of months, Figma has launched a slate of recent options, together with instruments for ideation, prototyping, and web site design.Rohan mentioned that watching Figma develop has additionally given him “extra confidence in the best way that I underwrite seed investing.” He is now the managing director of the In any other case Fund, the place a few of his high investments embody Hugging Face, Notion, Robinhood, and Vanta.