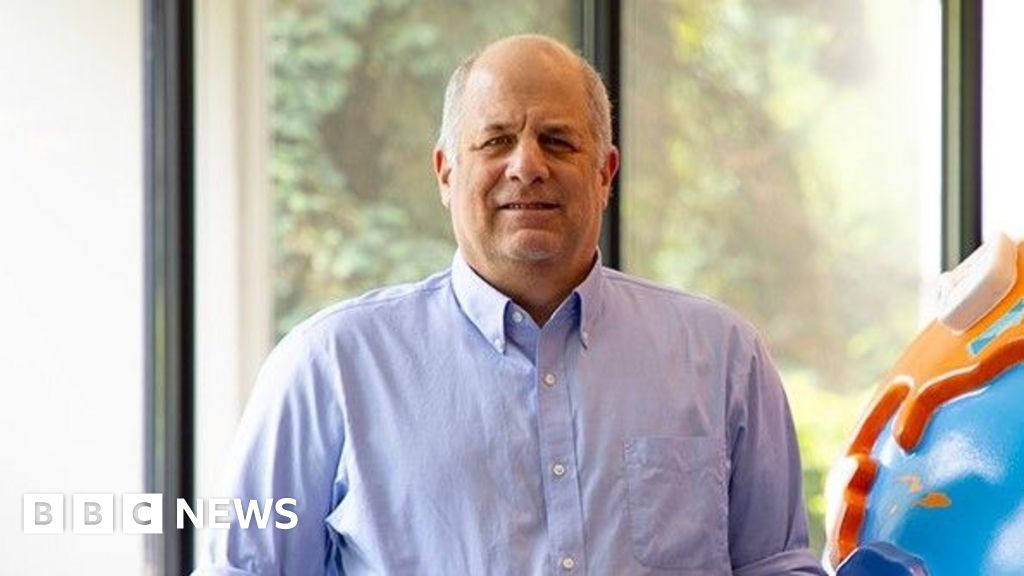

David SilverbergBusiness reporterLearning ResourcesRick Woldenberg says he believes in taking motion reasonably than simply “hoping for the perfect”A 90-day pause on Donald Trump’s sweeping tariffs plan is about to run out on Wednesday, which might upend US buying and selling relationships with the remainder of the world. However the uncertainty of the previous couple of months has already compelled a number of corporations to rethink their provide strains in radical methods. When an Illinois toymaker heard that Trump was introducing tariffs on Chinese language imports, he was so incensed that he determined to sue the US authorities.”I am inclined to face up when my firm is in real peril,” says Rick Woldenberg, who’s the CEO of academic toy agency Studying Assets.The vast majority of his firm’s merchandise are made in China, so the tariffs, which US importers need to pay, not Chinese language exporters, are actually costing him a fortune.He says his annual invoice for import taxes was projected to leap from round $2.5m (£1.5m) a yr in 2024 to greater than $100m in 2025, when in April Trump briefly elevated tariffs on Chinese language imports to 145%. That may have “devastated” the corporate, he says.”This sort of impression on my enterprise is just a bit bit exhausting to wrap my thoughts round,” he says.With US tariffs on Chinese language imports now at 30%, that is nonetheless unaffordable for a lot of American corporations comparable to Studying Assets.So along with its persevering with authorized struggle, it’s altering its world provide chain, shifting manufacturing from China to Vietnam and India.These two nations, like most others world wide, have seen the US hit them with basic 10% tariffs, two-thirds decrease than these on China. Though these 10% tariffs are because of run out on Wednesday, 9 July, uncertainly stays over what they could get replaced by.In the meantime, many Canadian corporations, who typically commerce in each their residence nation and within the US, are actually dealing with a double hit to their provide chains.These hits are the 25% tariffs put in place by Trump on many Canadian imports, and the reciprocal ones of the identical degree that Canada has positioned on a number of American exports.And different companies world wide are exporting much less to the US, as a result of their American import companions are having to place up costs to cowl the tariffs they now need to pay, which makes their merchandise costlier on US cabinets.At Studying Assets, Mr Woldenberg has now moved about 16% of producing to Vietnam and India. “We’ve got gone by way of the method of vetting the brand new factories, coaching them on what we wanted, ensuring that issues might circulation simply, and creating relationships.”But he admits that there are uncertainties: “We do not know if they’ll deal with the capability of our enterprise. A lot much less the entire world shifting in there on the similar time.”He additionally factors out that switching manufacturing to a different nation is dear to organise.Within the meantime, his authorized case in opposition to the US tariffs, referred to as “Studying Assets et al v Donald Trump et al” is constant its method by way of the US courtroom system.In Might a decide on the US District Court docket in Washington DC dominated that the tariffs in opposition to it have been illegal. However the US authorities instantly appealed, and Studying Assets nonetheless has to pay the tariffs in the interim.So the agency is constant to maneuver manufacturing away from China.Studying ResourcesLearning Assets has moved a few of its manufacturing from China to Vietnam and IndiaGlobal provide chain professional Les Model says that it’s each costly and tough for corporations to modify manufacturing to totally different nations.”Looking for new sources for essential elements of no matter you might be doing – that is a variety of analysis,” says Mr Model, who’s CEO of advisory agency Provide Chain Logistics.”There’s a variety of high quality testing to do it proper. It’s important to spend the time, and that basically takes away from the enterprise focus.”He provides: “The information switch to coach a complete new bunch of individuals on the right way to make your product takes a variety of money and time. And that results already razor-thin margins companies have proper now.”For Canadian fried hen chain Cluck Clucks, its provide chain has been considerably impacted by Canada’s revenge tariffs on US imports. It’s because whereas its hen is Canadian, it imports each specialist catering fridges and strain fryers from the US.Whereas it will possibly’t reside with out the fridges, it has determined to cease shopping for any extra of the fryers. But with no Canadian firm making different ones, it’s having to restrict its menus at its new shops.It’s because it wants these strain fryers to prepare dinner its bone-in hen items. The brand new shops will as a substitute solely be capable to promote boneless hen, as that’s cooked in a different way.”This was a considerable resolution for us, however we imagine it is the precise strategic transfer,” says Raza Hashim, Cluck Clucks CEO.”It is essential to notice that we do plan to retain the required kitchen house in new areas to reintroduce these fryers ought to the tariff uncertainty be utterly resolved sooner or later.”He additionally warns that with the US fridges now costlier for the corporate to purchase, the value it costs for its meals might need to go up. “There’s a specific amount of prices we can not take in as manufacturers, and we might need to cross these on to customers. And that’s not one thing we wish to do.”Mr Hashim provides that the enterprise is constant with its US growth plans, and it has arrange native provide chains to supply American hen. It at present has one US outlet, in Houston, Texas.Cluck ClucksRaza Hashim says he might need to put up pricesIn Spain, olive oil producer Oro del Desierto at present exports 8% of its manufacturing to the US. It says that the US tariffs on European imports, presently 10%, are having to be handed on to American customers. “These tariffs will instantly impression the tip shopper [in the US],” says Rafael Alonso Barrau, the agency’s export supervisor.The corporate additionally says it’s doubtlessly decreasing the amount it sends to the US, if the tariffs make buying and selling there much less worthwhile, and exporting extra to different nations as a substitute.”We do produce other markets the place we will promote the product,” says Mr Barrau. “We promote in one other 33 markets, and with all of them, and our native market, we might cushion US losses.”Mr Model says that corporations world wide would have been much less impacted if Trump had moved extra slowly together with his tariffs. “The pace and velocity of those selections are actually making all the things worse. President Trump ought to have gone slower and been extra significant about these tariffs.”Again in Illinois, Mr Woldenberg can be involved about the place Trump will go subsequent in his commerce battles.”We simply need to make the perfect resolution we will, primarily based on the data we have now, after which see what occurs,” he says.”I do not wish to say ‘hope for the perfect’, as a result of I do not imagine that hope is a technique.”Learn extra world enterprise tales

Trending

- Sony ZV-E10 II gets 4K 120 fps recording with free upgrade

- Empty shelves fill Coventry food hub volunteers with dread

- ARRI Reaffirms Commitment to Lighting and Camera Systems – Full Roadmap for 2026, Munich Consolidation Underway

- Brussels to give carmakers breathing space on 2030 climate targets

- Canada clears way for $60bn Anglo Teck merger

- UK and South Korea strike trade deal

- Runway announces its AI general world model GWM-1

- UK unemployment rate rises slightly to 5.1%