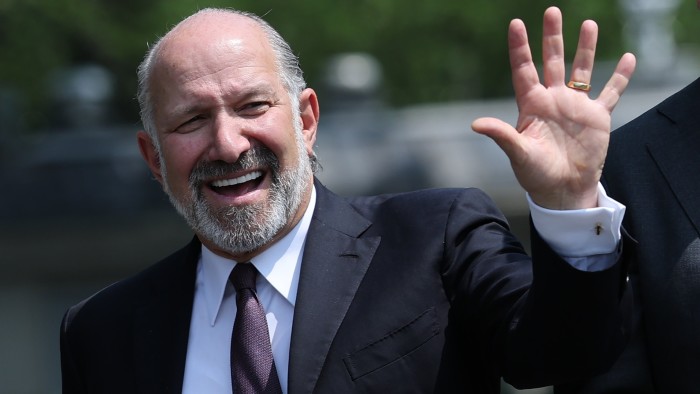

One scoop to start out: Latham & Watkins is about to poach a star dealmaker from Wachtell Lipton because the Los Angeles-founded regulation agency, one of many world’s largest by income, seeks to construct a company observe that may compete with its New York-based rivals.A brand new Musk enterprise: X chief government Linda Yaccarino has mentioned that customers will “quickly” be capable of make investments or trades on the social media platform, as she outlined a push into monetary companies in proprietor Elon Musk’s quest to construct an “every part app”. And one other factor: Danger advisory teams have seen a “sharp enhance” in inquiries as firms within the Gulf prepared contingency plans and activate disaster groups in preparation for any potential spillover of the Israel-Iran struggle.Welcome to Due Diligence, your briefing on dealmaking, personal fairness and company finance. This text is an on-site model of the publication. Premium subscribers can join right here to get the publication delivered each Tuesday to Friday. Commonplace subscribers can improve to Premium right here, or discover all FT newsletters. Get in contact with us anytime: Due.Diligence@ft.comIn at present’s publication: Lutnick hawks the ‘Trump Card’TSB’s again on the marketThe journey from international scandal to IPOThe FT’s name with Howard LutnickHoward Lutnick known as on Monday morning to pitch the “Trump Card”: a $5mn visa granting foreigners authorized residency within the US.The US commerce secretary informed the FT he had privately urged international dignitaries on his Center East journey to purchase the visa.Final week, he unveiled a web site — trumpcard.gov — for folks to sign their curiosity.As the decision with the FT’s Alex Rogers started on Monday, he claimed that 67,697 folks had already signed as much as the ready checklist and ended the transient interview noting that the determine had jumped to 68,703.Lutnick believes that the Trump Card — which he mentioned can be fabricated from gold — would rake in income for the US Treasury and entice international enterprise leaders, and their high-skilled employees, to America. The commerce division, nevertheless, has not crammed within the gaps. It deliberate to promote tens of 1000’s of visas this summer time, in keeping with folks aware of the matter, despite the fact that the programme in the meanwhile is a touchdown web page.To this point, the main points are slightly mild. The tremendous print — just like the parameters of a beneficial tax construction and vetting necessities — haven’t been hashed out but, or at the very least, haven’t been revealed publicly. One other query is how the cardboard would impression the cheaper EB-5 international investor visa, which was established a long time in the past by Congress.In fact, none of that’s stopping Lutnick, the ever-pugnacious banker and now Trump confidante and former chief government of Cantor Fitzgerald. “Every time I meet with worldwide executives, I at all times undergo it with them and promote it to them,” Lutnick informed the FT. “I can’t assist myself.”Banks circle TSBWhen BBVA made a hostile €11bn takeover bid for its rival Spanish lender Sabadell greater than a 12 months in the past, it opened up the chance that the Sabadell-owned UK financial institution TSB might find yourself again in the marketplace.This week, that chance grew to become extra actual when the FT’s Simon Foy and DD’s Ivan Levingston revealed that Sabadell was analyzing a sale of TSB after receiving unsolicited approaches.With bidders anticipated to submit presents this month, the FT additionally reported on Wednesday that the UK’s NatWest had dominated out bidding for TSB, whereas Barclays and Santander had been amongst these contemplating a suggestion.TSB has traded palms a number of occasions earlier than. Based because the Trustee Financial savings Financial institution in 1810, TSB had merged with Lloyds Banking Group in 1995 earlier than it was finally carved out from the enterprise because of a UK authorities bailout in the course of the monetary disaster.TSB then floated on the London Inventory Change in 2014, aiming to interrupt the grip of the massive UK excessive avenue banks on the retail market. It made some extent of scrapping inner gross sales targets and supplied clients larger rates of interest “with out the humorous stuff”, earlier than being purchased by Sabadell in a £1.7bn deal lower than a 12 months later.A deal for TSB would mark the most recent in Europe’s banking sector, which has seen a flurry of transactions and tried takeovers throughout the previous 12 months. Any potential new proprietor of TSB might be hoping for a easy change. When TSB transitioned from former proprietor Lloyds’ legacy infrastructure to Sabadell’s IT system in 2018, it left 2mn clients quickly locked out of their accounts, costing the financial institution £49mn in fines.Billionaire Batista brothers returnThey constructed their household slaughterhouse into the world’s largest meatpacker, solely to fall into shame over a corruption scandal.Now Brazil’s billionaire butcher barons are again.The triumphant return of brothers Joesley and Wesley Batista was sealed final week when the corporate they management, JBS, lastly listed its shares in New York, fulfilling a decade-long dream.It capped a exceptional journey for the controversial tycoons, who expanded the meat processor by worldwide acquisitions within the early years of the century to develop into a titan of the worldwide meals business.That achievement was in tatters lower than a decade in the past after they confessed to paying thousands and thousands of {dollars} in bribes to politicians of their homeland. The 2 males frolicked behind bars and nearly toppled a president.Following years within the wilderness, at present the pair as soon as once more transfer amongst prime politicians and businessmen within the South American nation. However the very public resurgence has sharpened scrutiny of the brothers.The US itemizing proposal needed to overcome an opposition marketing campaign by a coalition of conservationists and cowboys. Activists have lengthy accused JBS of fuelling deforestation within the Amazon. On the similar time, opposition lawmakers in Brasília declare that an vitality firm throughout the Batista’s wider enterprise empire acquired beneficial therapy from the leftwing administration of Luiz Inácio Lula da Silva.The Batista household holding group, J&F Investimentos, strenuously denies the allegations, as does the federal government. Regardless of the chance that the Batistas will enhance their voting energy at JBS because of the New York itemizing, minority shareholders had been finally enticed by the argument that it might increase the share value. “It’s essential for them to be again within the sport,” mentioned one one who is aware of the brothers. “They reside on it.”Learn the FT’s deep dive into the Batistas.Job movesBlackstone has employed Laura Coady as the brand new international head of CLOs in London, Bloomberg reviews. She beforehand labored at Jefferies.Trafigura’s head of strategic initiatives Julien Rolland is about to retire from the commodities dealer, within the newest high-profile departure from the worldwide group since Richard Holtum took over as chief government.Akin Gump has employed M&A companion Joshua La Vigne and funding administration companion Jessica Pan. They each beforehand labored at Mayer Brown.Good readsInner brawler Mark Zuckerberg has remodeled right into a red-blooded “Maga Mark”, FT Journal writes, stunning liberals at Meta. However was he like this all alongside? Photo voltaic Armageddon Republicans have swiftly proposed dismantling renewable vitality investments, the FT reviews. The bankruptcies have already arrived.Huge Tech’s divide Synthetic basic intelligence has been tipped as the subsequent large breakthrough out of Silicon Valley, the FT writes. However is it a scientific aim — or a advertising and marketing buzzword?Information round-upFrance to double stake in Eutelsat as Europe appears to be like for rival to Elon Musk’s Starlink (FT)Ex-Janus Henderson analyst responsible of insider dealing as he labored from house (FT)UK rebuffs Thames Water creditor calls for as administration looms (FT)Lockheed Martin approaches UK authorities with air defence pitch (FT)Wall Avenue leans on inventory merchants to cushion dealmaking slowdown (FT)Due Diligence is written by Arash Massoudi, Ivan Levingston, Ortenca Aliaj, Alexandra Heal and Robert Smith in London, James Fontanella-Khan, Sujeet Indap, Eric Platt, Antoine Gara, Amelia Pollard, Maria Heeter, Kaye Wiggins, Oliver Barnes, Jamie John and Hannah Pedone in New York, George Hammond and Tabby Kinder in San Francisco, Arjun Neil Alim in Hong Kong. Please ship suggestions to due.diligence@ft.comRecommended newsletters for youIndia Enterprise Briefing — The Indian skilled’s must-read on enterprise and coverage on the planet’s fastest-growing giant financial system. Join hereUnhedged — Robert Armstrong dissects a very powerful market traits and discusses how Wall Avenue’s finest minds reply to them. Join right here

Trending

- US puts £31bn tech ‘prosperity deal’ with Britain on ice | Trade policy

- ADWEEK 2026 Creative 100 Now Open for Nominations

- Ofcom investigates BT and Three for failing to connect 999 calls

- Ludlow food bank demand triples

- Strada Receives Strategic Investment From OWC to Accelerate Cloud-Free Collaboration

- Roomba maker iRobot bought by Chinese supplier after filing for bankruptcy | Manufacturing sector

- Charisse Hughes to Depart Kellanova Following Mars Deal

- What to delete from your emails to be taken more seriously at work