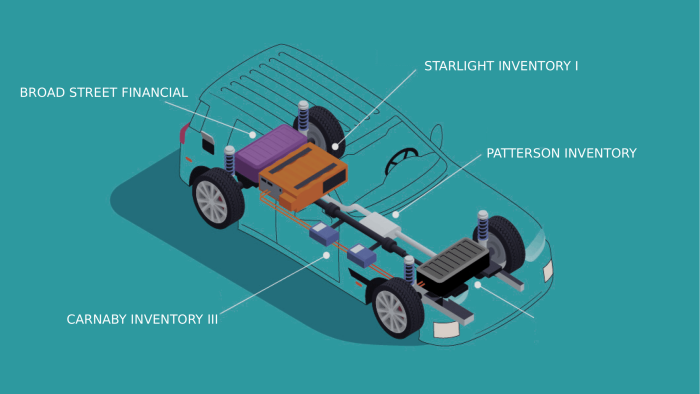

First Manufacturers Group is the newest automotive crash in credit score markets drawing a crowd of rubberneckers.The fast unravelling of the US maker of spark plugs, brake parts and windscreen wipers ticks lots of packing containers for an intriguing monetary fiasco story: the potential for multibillion-dollar losses; a mysterious proprietor; query marks over its use of off-balance sheet financing. On Thursday, mainFT broke information that exposed that not less than a few of these off-balance sheet buildings now seem like collapsing:Entities tied to First Manufacturers Group and its founder Patrick James have filed for chapter safety within the US, compounding points on the automotive components provider whose troubles have roiled credit score markets. Carnaby Capital Holdings and a number of other entities that raised debt linked to First Manufacturers filed for Chapter 11 proceedings on Wednesday, elevating the chance that the enterprise is itself getting ready to chapter. First Manufacturers, a US maker of windscreen wipers and gasoline pumps, has come underneath intense scrutiny for its use of off-balance-sheet debt tied to invoices and stock. Some lenders concern this financing was poorly disclosed in the primary working entity’s stability sheet, making it tough for collectors to know the way a lot debt it had in whole.To get a way of simply how messy this might get, the Carnaby chapter submitting states the businesses concerned have estimated liabilities of between $1bn and $10bn, in opposition to property of simply $500mn-$1bn.The proprietor of Carnaby is listed within the petition as Viceroy Non-public Capital, LLC. A public discover from Romania’s competitors council describes Viceroy as a US entity that’s “a part of the group of firms managed by Patrick James, which owns the Romanian subsidiary Trico Wipers Ploiești SRL”. Trico is a part of First Manufacturers Group.The chapter petition additionally lists a variety of “SPE Subsidiaries”; presumably an acronym for “particular objective entities”:FTAV readers are a sensible bunch, so we gained’t should say out loud the assorted company scandals which have concerned inventive monetary engineering utilizing SPEs.The SPE naming conference could be primarily based round locations in Ohio, the US state that Malaysian-born James set down roots in a long time in the past, on condition that Broad Avenue is within the metropolis of Columbus and different names match areas of the Buckeye State.Whereas First Manufacturers has made liberal use of bill factoring and reverse factoring — financing methods made (in)well-known in the course of the 2021 collapse of Greensill Capital — the names of lots of the entities point out that they have been probably used for stock finance. That is one other a part of the company finance instrument package that can be usually lumped underneath the umbrella of “working capital finance”, the place credit score is often raised in opposition to inventory in warehouses and such. Chances are you’ll be questioning: simply what sort of yield are you able to earn on these items?You may assume that curiosity could be modest on condition that these types of financing are usually secured and short-term in nature. However, if fund filings are any indication, you’ll be fallacious.Filings for AB CarVal’s Credit score Alternatives Fund confirmed that on the finish of final yr it held just a few million {dollars} of short-dated amenities for each First Manufacturers and Carnaby Stock III:The footnotes present that these have been Degree 3 property — primarily, {that a} market value was not used to find out their valuation. As an alternative, AB CarVal decided their “honest worth”. That each one means that these will not be simply tradable property.Elsewhere in its SEC filings, AB CarVal confirms that Carnaby Stock III is expounded to First Manufacturers, describing its debt as a “First Manufacturers Revolving Mortgage Facility”:FTAV readers might have already noticed the coupon on the First Manufacturers publicity listed in AB CarVal’s fund: 14 proportion factors over three-month SOFR, the mortgage market’s generally used floating-rate benchmark. That made for an all-in coupon of practically 19 per cent.Whereas no coupon is listed for the Carnaby be aware — with a footnote explaining that the “coupon fee will likely be decided on the time of settlement” — fund filings from a yr earlier present a fee of 13.63 proportion factors over SOFR on prior debt from the identical entity. Once more, that made for an all-in coupon of practically 19 per cent.It doesn’t take a working capital finance skilled to work out that’s a really excessive fee for short-term debt. The truth is, it’s far increased than the charges on the auto components maker’s long run loans that sit on the company stage. First Manufacturers’ $2bn first-lien mortgage maturing in 2027 — which was initially raised in 2021 — has a coupon of 5 proportion factors over SOFR. Even its second-lien mortgage, which ranks decrease within the queue in a chapter and is now quoted at round 15 cents on the greenback, solely carried an 8.5 proportion level unfold over SOFR.Filings from different funds point out that some traders might be reserving even increased returns on Carnaby paper.The Keystone Non-public Earnings Fund, managed by Utah-based personal credit score agency Keystone Nationwide Group, reported publicity on the finish of March to securities from Carnaby Stock IV. Apparently, whereas this entity follows the identical naming conference because the Carnaby Stock II and III entities included in Wednesday’s chapter submitting, Carnaby Stock IV just isn’t a part of the petition. It will appear a wierd coincidence if this entity just isn’t additionally linked to First Manufacturers, however FTAV will maintain an open thoughts till that element is confirmed. The “coupon charges” listed are as excessive as 50 per cent:Crucially, nevertheless, a footnote to those line merchandise reads: “Charge proven is set by inside fee of return calculation, and isn’t a real rate of interest.” So this seems to be a calculation of the all-in return Keystone is reserving on these offers relatively than the headline rate of interest.The Carnaby debt is listed underneath “Tools Leasing” in Keystone’s portfolio. The identical phase additionally holds debt underneath Trico Merchandise Company, a First Manufacturers subsidiary:On this occasion, the 12.5 per cent and 14.5 per cent coupon charges carry no footnote, so we presume they’re headline rates of interest.Readers may have noticed that AB CarVal’s First Manufacturers publicity was resulting from mature in Could, adopted by its Carnaby place in July. A later submitting exhibiting AB CarVal’s portfolio on the finish of June exhibits no publicity First Manufacturers. It does, nevertheless, present practically $4mn of publicity to to Carnaby Stock III and Carnaby Stock II (additionally a part of the chapter) now maturing at year-end:Keystone’s filings, in the meantime, indicated that it held a complete $60mn of Carnaby Stock IV publicity and practically $26mn of Trico paper. Neither of those entities is in chapter and the previous entity’s hyperlink to First Manufacturers continues to be tbd. The FT has reported that Trico Merchandise Company’s father or mother firm First Manufacturers Group is quickly hurtling in the direction of its personal Chapter 11 submitting, nevertheless.AB CarVal’s father or mother firm AllianceBernstein declined to remark. Keystone didn’t reply to requests for remark. We are going to replace the story if we hear again.Whereas we’ve targeted on the Carnaby debt, a fast scan exhibits publicity to a few of the different stricken SPEs in different funds. Do inform us if you happen to see (or know) something fascinating, both under the road or on e-mail.

Trending

- UK can ‘lead the world’ on crypto, says City minister

- Spain’s commitment to renewable energy may be in doubt

- Whisky industry faces a bleak mid-winter as tariffs bite and exports stall

- Hollywood panics as Paramount-Netflix battle for Warner Bros

- Deal or no deal? The inside story of the battle for Warner Bros | Donald Trump

- ‘A very hostile climate for workers’: US labor movement struggles under Trump | US unions

- Brixton Soup Kitchen prepares for busy Christmas

- Croda and the story of Lorenzo’s oil as firm marks centenary