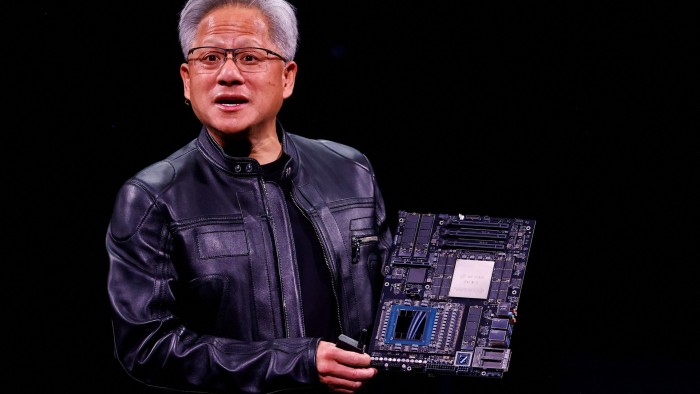

Unlock the Editor’s Digest for freeRoula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.Nvidia insiders have offered greater than $1bn of the corporate’s inventory over the previous 12 months together with a latest surge in buying and selling as executives money in on traders’ enthusiasm for synthetic intelligence. Greater than $500mn of the share gross sales passed off this month because the California-based chips designer’s share worth climbed to a report excessive. Buyers have piled again into the inventory, making it the world’s Most worthy firm as they wager on big demand for chips to energy AI functions. The value rise comes after a turbulent 12 months during which Nvidia was knocked by US-China commerce tensions and Chinese language AI breakthroughs that threated demand for its merchandise. Jensen Huang, Nvidia chief government, began promoting shares this week for the primary time since September. Nvidia stated all of Huang’s gross sales had been a part of a pre-arranged buying and selling plan, agreed in March, that set the costs and dates at which gross sales could be triggered. Huang stills retains the overwhelming majority of his shares in Nvidia.“When the inventory [dropped] within the first quarter, he didn’t promote, [which was] was actually good,” stated Ben Silverman, vice-president of analysis at VerityData. “[Huang] waited for the inventory to return to ranges that he felt extra snug promoting at,” Silverman added. VerityData, which tracks insider gross sales based mostly on regulatory filings, stated in a report that Nvidia’s share worth bump above $150 seems to have triggered Huang’s gross sales. Huang began promoting simply after a mandated 90-day cooling-off interval for his gross sales plan expired. Administrators and senior executives usually agree these plans to keep away from insider buying and selling allegations. Beneath the plan, Huang can promote as many as 6mn shares earlier than the tip of this 12 months. On the present share worth, that leaves Huang on observe to earn greater than $900mn.Huang’s internet price is estimated at $138bn, in response to Forbes.Nvidia’s market capitalisation has quadrupled to $3.8tn within the area of some years as corporations and nation states pour billions of {dollars} into the infrastructure behind AI.Plenty of different high Nvidia executives are additionally reaping a windfall from the corporate’s development. These embody longtime board member Mark Stevens, a former managing associate at Sequoia Capital who was one of many earliest traders in Nvidia. On 2 June, he introduced he would promote as much as 4mn shares, presently valued at $550mn, and has since offered $288mn of them.Nvidia’s government vice-president of worldwide area operations, Jay Puri — a two-decade veteran of the corporate who has deputised for Huang on journeys to China to fulfill officers — offered shares price round $25mn on Wednesday.Two different board members, Tench Coxe and Brooke Seawell, have moved to promote, with Coxe offloading round $143mn on June 9 and Seawell round $48mn this month. Coxe, a former managing director of Sutter Hill Ventures, is one other longtime board member who has been on the firm since its early days. Huang co-founded the corporate in 1993 as a online game graphics card firm in a Denny’s restaurant in San Jose. Seawell, who joined the board in 1997, is a associate at enterprise agency New Enterprise Associates and a former government at chip design software program firm Synopsys.Nvidia’s shares have rebounded in latest weeks, with its market capitalisation regaining about $1.5tn since its lowest level in April. The inventory took a success following breakthroughs by China’s DeepSeek and new US export controls on AI chips destined for China.

Trending

- Employment Rights Bill clears last parliamentary hurdle

- Donald Trump sues BBC for up to $10bn over edit of January 6 speech | Donald Trump

- Godox launches updated and improved AD300 Pro II all-in-one outdoor flash

- US lost 105,000 jobs in October and added 64,000 in November, according to delayed data | US economy

- UK insists negotiations over US tech deal still ‘active’

- Aiarty Video Enhancer Update Adds New AI Models and Control Options – Get 36% Off Now

- IAS Moves Beyond Verification With New AI Agent for Ad Campaign Optimizations

- Nissan Leaf production starts in Sunderland