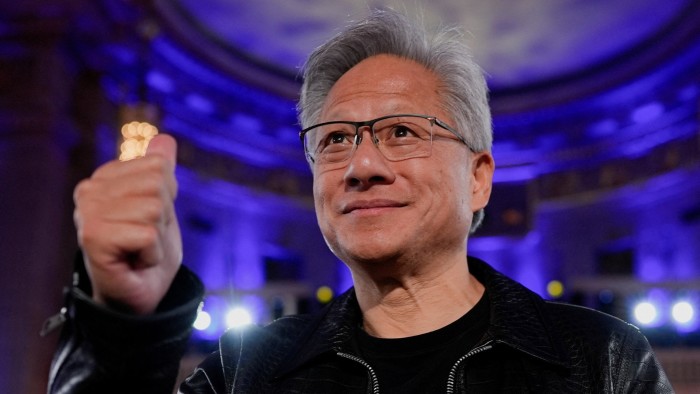

Good day from Yifan in Silicon Valley, your #techAsia host this week.It’s been a busy week for the chip business. Along with anxiously ready for the long-threatened semiconductor tariffs, now floated at round 300 per cent by US President Donald Trump, the largest AI and semiconductor business barometer, Nvidia, reported earnings on Wednesday.Regardless of logging one other over 50 per cent year-on-year income soar, traders appeared dissatisfied. Nvidia shares dipped over 3 per cent throughout prolonged buying and selling on Wednesday following the earnings launch.A part of the market response could be as a result of Nvidia’s street to recovering the China market is proving to be more durable than first anticipated.Whereas traders cheered the deal Nvidia and different chipmakers made with the Trump administration — 15 per cent of their income in trade for China export licenses — the Chinese language authorities is placing some new roadblocks on Nvidia’s return by calling the H20 chip — a downgraded synthetic intelligence chip specifically designed for the Chinese language market — a “safety danger.”Nonetheless, on Wednesday, Nvidia chief Jensen Huang stated he nonetheless sees China being a $50bn marketplace for the corporate this 12 months so long as it could actually present aggressive merchandise there, including that bringing its superior Blackwell graphics processing unit to the nation is a “actual chance.”It jogged my memory of a dialog I had with a enterprise capitalist from Beijing earlier this month about why the Chinese language authorities is asking out H20 and Nvidia. Along with the same old motive of selling Chinese language home chip provide, the VC urged bashing H20 is also the Chinese language authorities’s means of pressuring Nvidia and Washington to open up Blackwell for export.I chuckled and dismissed his “conspiracy concept” mind-set, however now wanting again, he might need been proper.In the meantime, one other US chip large can be making headlines. Intel bought about 10 per cent of its shares to the US authorities for grant cash from the Chips Act and one other defence programme it was already promised by earlier president Joe Biden’s administration earlier than Trump returned to the White Home.The fairness was not a part of the deal underneath the unique Chips Act phrases, and I distinctly bear in mind throughout a briefing with Biden’s Division of Commerce officers that they informed me the businesses would positively get the cash as promised as a result of it was in an enforceable “contract.” However tech firms are studying that Trump makes his personal preparations with little regard to precedent.In the meantime, Trump has stated that he needs to make extra offers just like the one with Intel, which means large fish like Taiwan Semiconductor Manufacturing Co and Samsung Electronics or different smaller Chips Act awardees may very well be subsequent.$2bn to $5bn price of geopoliticsFor the three-month interval ended July 27, Nvidia recorded $46.7bn in income, up 56 per cent on the 12 months and 6 per cent increased from the earlier quarter, the corporate introduced on Wednesday.For the third quarter, the corporate set anticipated income at $54bn, plus or minus 2 per cent. However the firm’s outlook is clouded by uncertainties in China because it didn’t embrace any gross sales of its H20 — a downgraded synthetic intelligence chip specifically designed for the Chinese language market — there within the estimate, Nikkei Asia’s Yifan Yu experiences.Along with its 15 per cent income sharing take care of the administration of US President Donald Trump but to be “codified,” Nvidia can be going through headwinds in China as Beijing lately summoned home tech giants together with ByteDance, Alibaba, Tencent and Baidu to debate their use of Nvidia chips over alleged safety considerations.“We’re nonetheless ready on a number of of the geopolitical points going backwards and forwards between the governments and the businesses attempting to find out their purchases and what they need to do,” Nvidia Chief Monetary Officer Colette Kress stated on Wednesday’s earnings name.But when the geopolitical points are resolved, the corporate estimates reaping $2bn to $5bn in H20 income for the continuing quarter, if no more.SoftBank’s Son favoured by TrumpSoftBank’s Masayoshi Son has emerged as certainly one of Donald Trump’s most favoured abroad traders, funding offers with OpenAI and Intel which were welcomed in Washington, write the FT’s David Keohane, Leo Lewis, Michael Acton, Stephen Morris and Joe Miller.Over golf, a number of conferences within the White Home and mammoth funding pledges, Son has been constructing shut ties to Trump ever since he was first elected. Son might want to preserve that relationship ought to he need management over extra bodily and politically delicate belongings.The SoftBank boss has been eyeing up Intel’s foundry enterprise — each the Japanese group and the US authorities at the moment are shareholders — and has formidable plans for an AI and robotics web site in Arizona.As his industrial efforts intensify, it’s also the political facet of his function in Washington that’s inflicting concern for Japanese diplomats, cautiously attempting to work the scenario to their benefit however railing towards Son’s place as a gatekeeper.“The dilemma is that if [Son is] not near Trump, he’s not usable,” stated Kunihiko Miyake, visiting professor at Ritsumeikan College in Kyoto and a former Japanese diplomat. “If he’s too shut, it’s harmful.”Up and upThanks to sturdy AI demand, complete internet income at publicly listed firms around the globe rose 7 per cent on 12 months within the April-to-June quarter, led by US synthetic intelligence and semiconductor firms, Nikkei’s Kensho Motowaki writes.Information from roughly 25,000 listed firms in Japan, the US, Europe, China and elsewhere — together with market forecasts in circumstances the place earnings weren’t launched — accounting for greater than 90 per cent of world market capitalisation, confirmed complete internet income rose to about $1.2tn, marking a fifth straight quarter of development.Some sectors specifically shined. Web income in data expertise surged 58 per cent, whereas electronics, together with semiconductors, noticed a 16 per cent enhance in internet income.In distinction, tariff-sensitive industries suffered, with automakers’ internet income dropping 37 per cent.No China instruments for 2-nanometer chipsTaiwan Semiconductor Manufacturing Co is not going to use Chinese language instruments in its newest 2-nanometer chipmaking manufacturing traces — essentially the most superior in all the business — which can go into mass manufacturing this 12 months, Nikkei Asia’s Cheng Ting-Fang experiences.The transfer is to keep away from any potential US restrictions that would disrupt 2nm manufacturing which is scheduled to start out first in Hsinchu, Taiwan, adopted by the southern Taiwan metropolis of Kaohsiung. The Taiwanese chip titan can be constructing a 3rd plant in Arizona to finally make such chips.TSMC’s choice was influenced by a possible US regulation that would prohibit chipmakers that obtain American funding or monetary assist from utilizing Chinese language manufacturing tools, sources stated.Urged readsThe possible winners and losers from Trump’s threatened 300% chip tariff (Nikkei Asia)Japanese media teams sue AI search engine Perplexity over alleged copyright infringement (FT)China crackdown boosts lithium costs, however how lengthy can the rally final? (Nikkei Asia)Temu resumes direct delivery from China to US after Trump truce (FT)China’s meals supply low cost warfare chops Meituan revenue by 97% (Nikkei Asia)Sony is constructing an enormous video games empire: can it maintain management? (FT)Japan to speculate $68bn in India over 10 years, together with AI and chips (Nikkei Asia)Chinese language semiconductor shares surge after DeepSeek offers enhance to homegrown chips (FT)Japanese newspapers Nikkei and Asahi sue Perplexity AI over copyright (Nikkei Asia)TikTok to put off a whole lot of UK moderators because it shifts to AI (FT)#techAsia is co-ordinated by Nikkei Asia’s Katherine Creel in Tokyo, with help from the FT tech desk in London. Join right here at Nikkei Asia to obtain #techAsia every week. The editorial crew may be reached at techasia@nex.nikkei.co.jp

Trending

- Warner Bros to reject $108bn Paramount bid, reports say

- All Networks Up Double-Digits in Primetime

- New £150m funding package to protect jobs at Grangemouth

- Jared Kushner’s firm exits takeover battle for Warner Bros Discovery | Media

- Learner drivers face 24-week wait as backlog continues for two more years

- Nikon Z9 Firmware 5.30 Released – Expanded Subject Detection, Focus Limiter, and Flexible Color Picture Control

- Nielsen’s The Gauge Ratings for November 2025

- EU waters down plans to end new petrol and diesel car sales by 2035