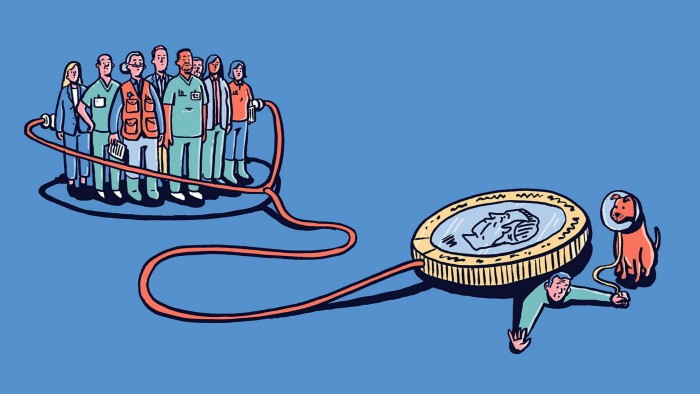

Keep knowledgeable with free updatesSimply signal as much as the Retail & Shopper trade myFT Digest — delivered on to your inbox.Embarrassment is a robust emotion in canines as it’s in people. Baskerville, our household pet, returned from the vet on Monday final week sporting a “cone of disgrace” — a plastic collar that stops an animal from licking a wound.His expression was that of a dashing cavalry officer busted all the way down to the ranks for falling off his horse drunk throughout The Trooping of the Color. His large, brown eyes requested: “Why has my beforehand excellent life out of the blue gone so horribly incorrect?”Our native veterinary apply, half of a giant chain, offered quick, skilled and caring therapy for Baskerville’s contaminated toe. It then caught us with a invoice for slightly below £250.This appeared so much, albeit that we additionally splashed out on three high-end worming capsules. Fellow pet house owners whimper of remedies costing many 1000’s.It was throughout my subsequent analysis into the hovering price of preserving a canine or cat that I discovered proof of human embarrassment suffered by those that run massive vet practices as acute as that of our labradoodle.This got here within the type of scissor icons in a important report on the enterprise practices of vet chains that cater for pets printed by the Competitors and Markets Authority in February. I perceive the scissors characterize redactions demanded by legal professionals representing the chains.They seem the place, contextually, you may anticipate the CMA to comment: “These vet chains! They’re making out like bandits!” There are 843 scissor icons within the 124-page report and you’ll wager the legal professionals requested for a lot extra. The report “betrays indicators of a wrestle”, as a police forensics officer may put it.Three key CMA findings survived the tussle. First, the price of taking a pet to the vet rose by 60-70 per cent in 2016-2023, when shopper providers worth inflation was 35 per cent. Second, this isn’t satisfactorily defined by fancier remedies changing into accessible. Third, some 60 per cent of neighbourhood vets at the moment are managed by massive chains, in contrast with 10 per cent in 2013.Three out of six of the big chains — IVC, VetPartners and Medivet — are owned by non-public fairness. The opposite three are corporates.By some bizarre coincidence, these entrants have all wound up placing cash right into a extremely fragmented trade, beforehand dominated by owner-practitioners whose motivations had not been primarily monetary and whose clients will usually put up with worth rises. What attainable sport plan might they’ve?A realist may reply: “Consolidation, systematisation, reaping economies of scale, chopping prices and elevating costs.”Turning to Baskerville’s latest vet invoice I discerned a traditional razor/blades pricing technique, the place profitability is determined by discounting the client’s main buy and marking up gross sales that consequence from it. The session was an affordable 70 quid or so. The majority of prices was accounted for by medicine. These had been equipped at as much as eight occasions costs marketed by on-line pharmacies.Then I checked out printed accounts. All these redactions had made me curious concerning the funds of the vet chains. Excessive profitability is typically an indication that competitors in a market is weak.The veterinary division of London-listed Pets at Residence has a revenue margin fatter than an aged golden retriever that ate the Sunday joint whereas its proprietor was out of the kitchen. It stood at 43 per cent on the final document date. However this apparently displays hefty cross subsidies from pet provide shops the place many Pets at Residence practices are positioned.IVC, VetPartners and Goal-listed CVS reported revenue margins of round 20 per cent at their final document dates, as measured by adjusted ebitda (earnings earlier than curiosity, tax, depreciation and amortisation). That determine could also be extra consultant of enormous vet chains. It isn’t extreme for service companies.IVC is the largest chain and stands out for the aggressive tempo of its growth. It has greater than 900 vet practices, round 24 per cent of the UK whole, based on CMA information. Homeowners intention to create a useful asset they’ll promote for a capital achieve. On the finish of final September, internet money owed stood at round £4bn, a racy six occasions adjusted ebitda.So what’s a canine or cat proprietor to do within the face of rising payments? Listed here are some strategies: Ask native vet practices what costs they cost for normal remedies equivalent to vaccinations, spaying, castration and filling in journey permits.Discover out who owns the enterprise. Remaining independents could have extra discretion to low cost prices.Register with a vet whose prices seem wise and whose providers are really helpful by different pet house owners.Be cautious of signing up for subscription providers that appear inexpensive on a month-to-month foundation, however look costly while you multiply by 12.Assist could also be at hand. The CMA is because of publish an motion plan for making vet providers extra aggressive in September, finalising it subsequent February.Spare a thought, in the meantime, for hard-working vets. Some at the moment are saddled with gross sales targets and month-to-month evaluations of their monetary efficiency. Vet chains ought to bear in mind the historic classes of the AA and Royal Mail — alienating a publicly standard workforce could be dangerous for enterprise.As for Baskerville, his toe has healed properly. He’s spared the plastic collar and folks now not chuckle and level as he walks down the road. However we are going to hold the cone of disgrace to remind him that house owners name the pictures for pets at dwelling — if not on the checkout of the native vet.Jonathan Guthrie is a author, an adviser and a former head of Lex; jonathanbuchananguthrie@gmail.com

Trending

- Key takeaways from DMEXCO 2025

- JLR suppliers with ‘days of cash’ left, MP says

- Insta360 Wave Conference Speakerphone

- Meta Expands Teen Protections on Instagram, Facebook and Messenger

- Snapchat Expands Bitmoji Stickers Beyond the App

- Quick Fix – Everyday AI Masking Applications in Post-Production

- Cocktail of the week: Courtyard Wine Cellar’s pear and white wine fizz – recipe | Cocktails

- Arlington House and the future of the UK’s brutalist high-rises