Take heed to the article

2 min

This audio is auto-generated. Please tell us in case you have suggestions.

Snapchat is tremendous eager to lift consciousness of promoting alternatives in Q5, with current Snap knowledge displaying that 88% of U.S. Snapchatters store for items within the post-Christmas interval.

The potential right here may very well be a giant winner in Snap’s end-of-year income push, and it’s seeking to increase consciousness amongst advertisers to spice up advert spend within the interval.

To additional underline this, Snapchat lately commissioned Ipsos to conduct a survey of over 5,711 customers throughout 5 markets, to be able to glean extra perception into how they plan to buy post-Christmas this yr.

And in the event you’re nonetheless mapping out your vacation advertising and marketing plan, it could be value preserving some funds for Snap adverts in Q5, primarily based on these insights.

First off, the information reveals that 60% of customers proceed purchasing after Christmas, with Snapchat customers, particularly, seeking to purchase within the interval.

As per Snap:

“With present playing cards to spend, time off to chill out, and budgets deliberate forward, Snapchatters see Q5 as their second to deal with themselves and others.”

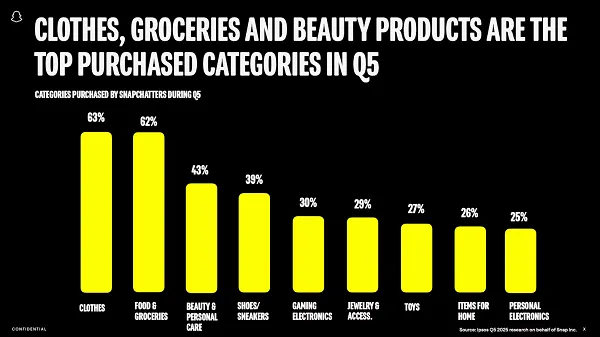

The info additionally reveals that customers are (logically) purchasing extra for themselves than others within the post-Christmas interval, with style, magnificence, electronics and meals among the many top-selling classes.

The report additionally reveals that Snapchatters are extra lively in Q5, as they appear to attach with associates, and share vacation snaps:

“In reality, New 12 months’s Eve is the #1 engagement day on Snapchat, making it the proper second for manufacturers to attach.”

And there’s additionally the New 12 months’s resolutions to think about, and the advertising and marketing alternatives inside these self-pledges:

So there are ample alternatives to attach and encourage purchasing conduct within the interval, which may make it a useful consideration to your advertising and marketing and outreach efforts.

In fact, Snap has its personal motivations for pushing this ingredient. With Australia set to extend its social media age restrict to 16, and different areas contemplating comparable, Snap may very well be notably exhausting hit, dropping its reference to a big chunk of its youthful viewers. Which may hurt its advert potential shifting ahead, so it is smart for Snap to be making a push now, to be able to increase its advert gross sales nevertheless it may.

However the knowledge does spotlight some useful alternatives, and potential for manufacturers.

You’ll be able to learn Snapchat’s Q5 insights report right here.