Snapchat has reported its Q3 efficiency replace, which exhibits constructive progress on a few key fronts, although some considerations nonetheless stay, significantly when it comes to rising prices, that are solely set to leap larger within the new yr.

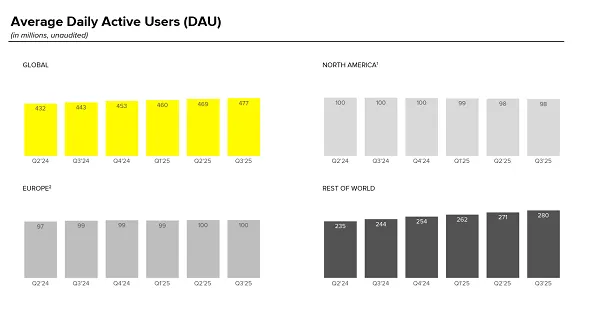

First off, on customers. Snapchat is now as much as 477 million every day actives, which is a rise of 8 million on Q2.

Which is just about the identical as the rise that it’s posted every of the previous couple of quarters, with all of Snap’s consumer development coming within the “Remainder of World” class. Certainly, Snap added no new customers within the U.S. or Europe, with each areas trying to have stalled out, or reached saturation level for the app.

Which caps Snapchat’s development, and with extra areas now contemplating larger age restrictions for social media use, that’s not a terrific signal for Snap’s ongoing alternatives.

Snapchat has addressed this concern in its accompanying notes, explaining that:

“These coverage developments, mixed with potential platform-level age verification, are prone to have unfavourable impacts on consumer engagement metrics that we can’t presently predict.”

Yeah, that’s not an excellent signal, and whereas Snap does additionally word that it’s utilizing new indicators from Apple and Google to find out consumer ages (?), that may doubtless have a huge impact on platform utilization, particularly in markets the place Snapchat’s not including any extra customers.

That’ll restrict the platform’s monetization potential. And whereas constructing in growing markets will present longer-term alternatives, its speedy consumption might take a success.

However proper now on the income entrance, issues are trying okay:

Snapchat introduced in $1.5 billion in income for the quarter, pushed, it says, by:

“Continued development in our small- and medium-sized enterprise (SMBs) prospects, and enhancements in direct response promoting efficiency”

Snapchat’s been working to enhance its advert focusing on instruments, and placement choices, and it looks as if these efforts are having a constructive affect, with extra advertisers trying to faucet into the app’s recognition with youthful customers to increase their attain.

Snapchat’s additionally now bringing in $750 million per yr from Snapchat+ subscriptions. So even with much less development in its core income markets, it’s benefiting from what it’s obtained.

And it’s additionally reassessing its enterprise strategy to place extra give attention to its key income markets:

“This consists of testing adjustments to our infrastructure that may decrease prices in areas with much less long-term monetization potential, permitting us to raised align our sources with the monetary alternative of every geography, however probably coming at the price of adversarial trade-offs with engagement in these nations.”

As a result of once more, whereas including extra customers, as a prime line quantity, appears nice, the very fact is that Snap isn’t going to be incomes as a lot income from these customers, because of regional income variances. Snap is addressing this, however it’s an necessary acknowledgement, which highlights this as a key concern, versus seemingly hoping the consumer rely will distract traders.

When it comes to utilization, Snap says that international time spent watching content material has elevated year-over-year, “reflecting our multi-year funding in machine studying and the continued power of Highlight.” Snap says that it’s launched its largest content material advice mannequin thus far, “enhancing freshness and relevance throughout the platform,” whereas it’s additionally upgraded its infrastructure to “get a step nearer to delivering content material in close to real-time, lowering latency and slicing mannequin coaching cycles from days to only two hours.”

Highlight has grow to be a key engagement driver for the app, with views in its short-form video feed rising greater than 300% year-over-year within the U.S.

Brief-form video is probably the most participating format on all social apps, so that is no actual shock, however it’s attention-grabbing to see Snap re-purposing TikTok’s core providing, in the identical manner that Instagram repurposed Tales.

Snap has additionally reported that month-to-month energetic customers at the moment are as much as 943 million, closing in on that one billion consumer milestone.

So some good indicators, with Snapchat trying to refocus its enterprise round its core alternatives, whereas it’s additionally introduced a brand new take care of Perplexity to combine Perplexity’s AI-powered reply engine immediately into Snapchat.

Extra alternatives for extra engagement, and maximize its viewers potential. Although there’s one different aspect that’s additionally of concern.

Snapchat’s prices are nonetheless rising, and with the corporate trying to launch its AR-enabled Specs subsequent yr, these prices are inevitably going to rise even additional, for a product that also appears unlikely to be the most suitable choice in the marketplace.

Meta’s AI glasses already supply higher performance, and with each Meta and Apple launching their very own AR glasses within the close to future, the chance for AR Specs appears restricted.

Nonetheless, Snap’s sticking with it, although it has additionally, no less than reportedly, thought of spinning off Spectacles into its personal enterprise, as a way to restrict the impacts on Snap.

That looks as if an excellent strategy, albeit a fancy one, as a result of I proceed to imagine that AR Specs are going to grow to be an albatross for the corporate, which is able to tank its valuation by the tip of subsequent yr. And it doesn’t have the strong advert enterprise of its rivals to fall again on, so it could possibly be taking a look at a tricky time forward, except Specs are an absolute hit out of the gate.

I don’t see that occuring, however the hype round its authentic Spectacles was excessive when it first launched them again in 2016 (even when they did find yourself costing Snap cash because of unsold stock).

Perhaps, that preliminary hype will result in a extra constructive alternative for AR Specs.

We’ll discover out in a couple of months.