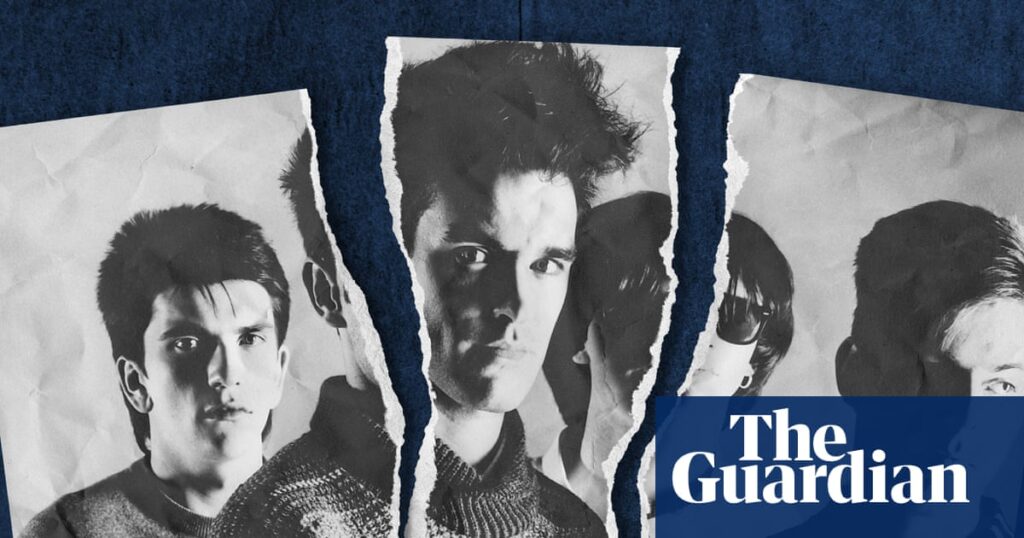

There’s a well-trodden line about assessing the trustworthiness of on-line bargains: if it seems to be too good to be true, it most likely is. It involves thoughts when trying on the extraordinarily uncommon method during which Morrissey is seemingly in search of to dump his enterprise pursuits within the Smiths. This isn’t just like the forensic and formal processes behind big catalogue gross sales in recent times akin to Sting, Bob Dylan, Queen, David Bowie, Bruce Springsteen, Pink Floyd or Paul Simon.A publish on Morrissey Solo – the outlet for all official Morrissey communiques – says the singer has “no selection however to supply on the market all of his enterprise pursuits in ‘the Smiths’ to any get together/investor” and that he desires out. Possibly psychologically that is the closure he wants – the band won’t ever reform, given bassist Andy Rourke’s demise in 2023 and Morrissey’s clear private and political variations with guitarist Johnny Marr – however, in straight enterprise phrases, that is shockingly cavalier.All of it has the musty whiff of a yard sale. There’s a Gmail tackle listed as the one channel of contact for potential bidders. Besides while you electronic mail it, you get a bounce again saying no such tackle exists.“Placing a rights sale on a free electronic mail account appears like the company equal of scrawling ‘guitar on the market’ on a lamp-post,” says Cliff Fluet, a associate at authorized agency Lewis Silkin, a extremely revered veteran of catalogue gross sales. “Critical buyers will anticipate knowledge rooms, warranties and correct disclosure. A Gmail pitch says none of that’s coming, so heavyweight bidders will both steer clear or mark the worth down closely to cowl the chance.”Most of Morrissey’s Craigslist-style publish is imprecise, speaking about “all” Smiths recording and publishing rights, merchandise rights, logos and so forth being bundled up on the market. But he doesn’t personal any of those outright and even turned down a suggestion from Marr to share management of band-related logos. Uncertainty reigns. Will he signal a cope with Marr forward of this sale to clear obstacles for potential new homeowners? That’s the nice unanswerable query. Marr’s administration declined to remark when requested by the Guardian.Morrissey and Marr pictured in happier occasions. {Photograph}: Brian Rasic/Getty ImagesThere is an argument that bitter in-fighting, non-communication and Morrissey’s personal controversial political pronouncements in recent times have severely broken the Smiths model. Repairing and reviving it’s maybe by no means going to occur underneath present possession, so one thing has to alter.“On the face of it, Morrissey is solely cashing out of a partnership that seems to be gone ‘irretrievably damaged down’,” suggests Fluet. “It feels much less like a strategic play and extra like a want to stroll away with no matter worth he can nonetheless extract.”Alan Wallis is CEO of Dynamite Songs and beforehand ran the music transactions observe at Ernst & Younger within the late Nineties and early 2000s, so has seen the altering dynamics of catalogue gross sales up shut for greater than 1 / 4 of a century. He says promoting a significant stake in a commercially and culturally vital music catalogue on this idiosyncratic method is completely with out precedent.How such gross sales usually occur, he says, is that “you set collectively a pack with all the data that somebody who’s shopping for it will must make a non-binding supply. Then you definately go right into a diligence course of with monetary data for the final three to 5 years.” After that, the vendor must put all associated contracts in place. “That is to point out that you simply’ve bought title for no matter these property are and that you simply personal these property,” he says.From there, the method is often to solicit a small variety of severe bidders. “Usually, you wouldn’t exit far and huge,” says Wallis. “You’d do it to a restricted quantity [of potential bidders]. You decide who the likeliest are. What you need is slightly little bit of stress between the 2 or three [bidders] to attempt to maximise the worth. I don’t suppose that is going to attain that.”Wallis’s concern is that providing a sale on this method may very well be learn by the market as an indication of desperation. Its unconventional nature and construction could scare off severe bidders akin to document corporations or main rights buyers. This might imply extra mercenary gamers step ahead, ones who’re equally mercenary of their bids. “Once you take a look at it and also you learn how he simply desires to get away from [the Smiths], bidders would low ball,” suggests Wallis.Fast gross sales can occur, however invariably they’re dramatically under market worth.Rourke, Marr, Morrissey and Joyce pictured in 1987. {Photograph}: Andre Csillag/Rex FeaturesThe Smiths had been initially signed to Tough Commerce in 1983 however their catalogue of recordings is now owned by Warner Music Group. The collapse of the Tough Commerce distribution community in 1991 noticed the Tough Commerce label dump its total catalogue to assist repay money owed on the distribution aspect. A supply with inside information advised the Guardian that Warner paid £1m for the Smiths’ recordings on this hearth sale (equal to £2.3m in the present day). “On reflection,” they are saying, “it was far too low cost.” As such, any plans for the band’s recordings would want the complete involvement of Warner. Consumers shall be getting an vital share, not whole autonomy.Then there’s Marr himself. As co-writer of all of the Smiths’ songs, he controls 50% of their publishing. He’s additionally at the moment the only proprietor of their related logos, which can immediately impression something associated to merchandise. Anybody scooping up Morrissey’s stake will nonetheless have to seek out frequent floor with Marr and he could have the facility to overrule any business plans if he feels they’re inappropriate or probably detrimental to the band’s legacy and incomes potential.“You’d be shopping for into joint possession with a co-writer who holds the trademark – on behalf of them each – and who has veto energy over most business makes use of,” explains Fluet. “With out Marr’s nod, you don’t get management; you get a near-permanent negotiation.”skip previous e-newsletter promotionGet music information, daring evaluations and surprising extras. Each style, each period, each weekPrivacy Discover: Newsletters could include details about charities, on-line adverts, and content material funded by exterior events. In the event you wouldn’t have an account, we are going to create a visitor account for you on theguardian.com to ship you this article. You’ll be able to full full registration at any time. For extra details about how we use your knowledge see our Privateness Coverage. We use Google reCaptcha to guard our web site and the Google Privateness Coverage and Phrases of Service apply.after e-newsletter promotionMorrissey had full inventive management over the document sleeves for all Smiths releases on Tough Commerce. As their creator or inventive director, he technically would have owned the IP in them since Tough Commerce was not as obsessed as the most important labels with nailing every part down contractually. The sale of {the catalogue} to Warner, nonetheless, is more likely to have contained a clause whereby possession of art work and promo movies could be rolled into the sale of the grasp recordings.One decision, in fact, could be that Marr and his workforce purchase out Morrissey’s stake, that means all of the creator rights sit in a single pot and there are not any issues or fraught negotiations wanted to clear makes use of akin to synchronisation offers. But given Morrissey’s terse assertion (“I’m burnt out by any and all connections to Marr, Rourke, Joyce”), it might be the case that he would peevishly refuse to promote to his former inventive and enterprise associate.The art work for Meat Is Homicide, one among Morrissey’s designs for the Smiths’ document covers. {Photograph}: Album artworkThere is, argues Fluet, an excessive amount of monetary uncertainty right here for any potential purchaser. “The one reliable money for a purchaser lies in Morrissey’s receipts of publishing and grasp recording royalties – the receivables that are available in each quarter,” he says. “However even that revenue depends upon the vendor standing behind his paperwork and staying prepared to cooperate on audits and future clearances. Proper now, patrons can’t be certain of both.”With politics and relationships being as curdled as they’re, and the impression this has had on the band’s legacy administration in each inventive and business phrases, the asking value may very well be considerably decrease than one would possibly anticipate for such an vital catalogue.“In an ideal world – clear chain of title, no arguments, full cooperation – a Smiths catalogue might fetch tens of tens of millions,” estimates Fluet. “This isn’t that world. Overlapping claims, years of authorized sparring and the trace of contemporary litigation imply any bidder will apply a chunky low cost.”That is, even when every part is because it claims to be, undoubtedly probably the most uncommon tactic to promote a big catalogue and bundle of rights.Wallis, wincing on the truth bids should be submitted through a Gmail tackle (functioning or in any other case), says Morrissey actually wants hardened professionals round him to strike an equitable sale value. “Somebody’s going to have to assist him do that deal,” he says. “I don’t know who’s going to be trying on the affords that are available in.”This, frankly, is simply not how music rights gross sales are accomplished. “It may be a pathetic try at attempting to get consideration,” sniffs one extremely knowledgable music trade supply.One other well-placed trade title is partly sanguine and partly drily cynical: “Will probably be attention-grabbing to see if he truly means it.”

Trending

- Jared Kushner’s firm exits takeover battle for Warner Bros Discovery | Media

- Learner drivers face 24-week wait as backlog continues for two more years

- Nikon Z9 Firmware 5.30 Released – Expanded Subject Detection, Focus Limiter, and Flexible Color Picture Control

- Nielsen’s The Gauge Ratings for November 2025

- EU waters down plans to end new petrol and diesel car sales by 2035

- A Tale of Two Clocks: Making Both Brand Performance and Value Tick

- Former chancellor George Osborne joins OpenAI

- Color.io Shutting Down – Popular Film Emulation and Color Grading Tool Goes Offline December 31