The Winklevoss twins are aiming for a $2.22 billion IPO for his or her cryptocurrency change Gemini, the corporate introduced in a press launch on Tuesday. Crypto is having a second because of the Trump administration’s lax regulatory insurance policies. In the meantime, the IPO market is heating up once more with splashy debuts from different tech shares like Chime and Figma. The 2 components mixed make for a very worthwhile atmosphere for crypto-related shares and IPOs. When it debuts, Gemini will turn into the third publicly traded crypto change within the U.S., becoming a member of Coinbase and Bullish. Coinbase went public in 2021, and Bullish pulled off a blockbuster debut in August. Gemini confidentially filed for an IPO again in June, and the corporate introduced in a press launch on Tuesday that it plans to promote 16.67 million shares at a value vary of $17 to $19, beneath the ticker “GEMI.” Goldman Sachs and Citigroup are main the deal. If the market appears to agree with this valuation, the Winklevoss twins’ crypto platform may elevate as much as $317 million from the providing.

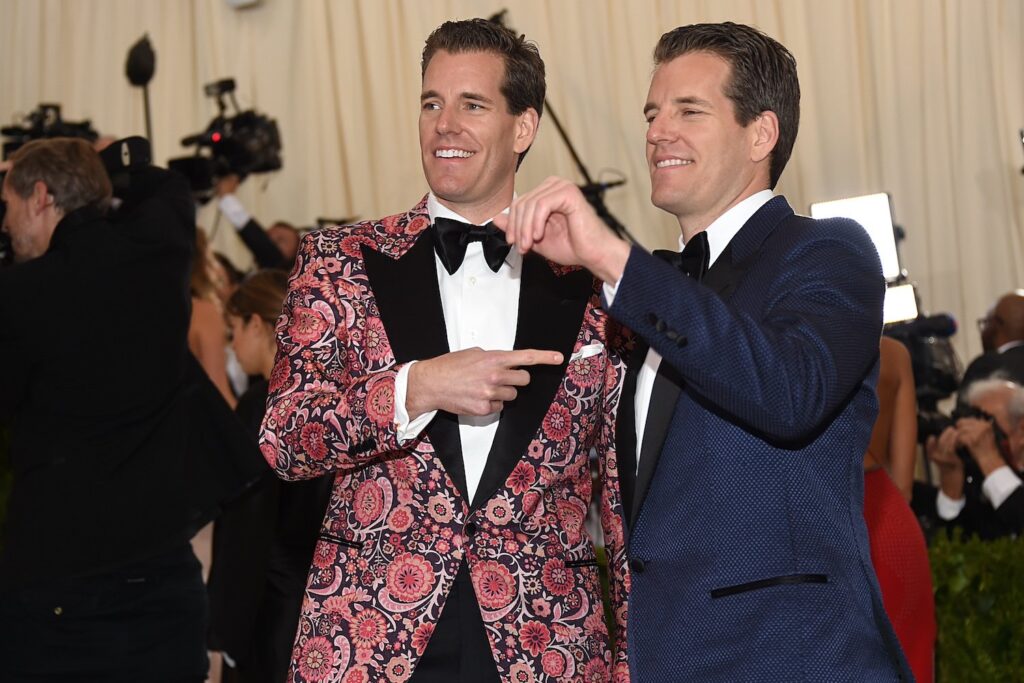

Cameron and Tyler Winklevoss based Gemini in 2014, years after they first made headlines of their authorized battle towards Mark Zuckerberg over Fb. They invested the cash they received from that settlement into early bets on bitcoin, securing the nickname “Bitcoin Twins.” The twins have discovered themselves in authorized troubles of their very own over Gemini. Again in 2022, the Commodity Futures Buying and selling Fee filed a 28-page civil swimsuit towards Gemini, claiming that it made deceptive statements to U.S. regulators in 2017 about whether or not its proposed bitcoin futures contract may very well be simply manipulated by merchants. Gemini’s bitcoin futures contract on the time was one of many first to checklist digital property. The corporate reached a $5 million settlement with the CFTC in January 2025. The corporate was additionally sued by the New York lawyer normal in 2023 for an alleged $1 billion cryptocurrency fraud.

A win for the Winklevii The professional-crypto regulatory shift within the U.S. authorities has led to an enormous increase within the trade. The Winklevoss twins—referred to generally because the Winklevii—have been among the many crypto leaders who received large with the 2024 election. Except for the fossil gasoline trade, crypto outspent another single trade on political candidates within the 2024 election. Because of this, 253 pro-crypto candidates have been elected to the Home of Representatives versus 115 anti-crypto candidates, and 16 pro-crypto candidates have been elected to the Senate versus 12 anti-crypto candidates.

The twins are staunch supporters of President Donald Trump. Forward of Trump’s election, Cameron Winklevoss shared in a publish on X that he donated $1 million in Bitcoin to his marketing campaign as a result of he would “put an finish to the Biden Administration’s struggle on crypto.” The twins’ help secured them entry to the President’s ear, which they later used to press Trump to rethink his nominee to steer the Commodity Futures Buying and selling Fee. Crypto pushes into the monetary mainstream Regardless of being closely skeptical of cryptocurrency beforehand, Trump and his household now have a considerable stake within the sport with crypto as effectively. In only a matter of seven months, his administration has overseen an onslaught of regulatory actions supposed to push cryptocurrency additional into the monetary mainstream.

Trump signed the Genius Act into legislation in July, which established the primary federal regulatory framework for stablecoins, a kind of cryptocurrency that’s pegged to the U.S. greenback in an effort to curb crypto’s infamous volatility. Final month, the Trump-appointed SEC Chairman Paul Atkins launched “Mission Crypto,” a roadmap detailing the Fee’s pro-crypto regulatory method. The change within the regulatory atmosphere for crypto emboldened the monetary aspirations of the trade, together with IPOs.

Earlier this summer season, stablecoin firm Circle’s IPO on the New York Inventory Alternate was met with nice investor curiosity. Lower than a month earlier than Circle’s IPO, publicly traded Coinbase turned the primary U.S. crypto firm to hitch the S&P 500, marking an enormous milestone for the trade. The Gemini IPO is ready to be one other win for the blockbuster 12 months that the crypto trade is having, as with every profitable IPO, crypto digs its method deeper into securing its place within the mainstream monetary world.