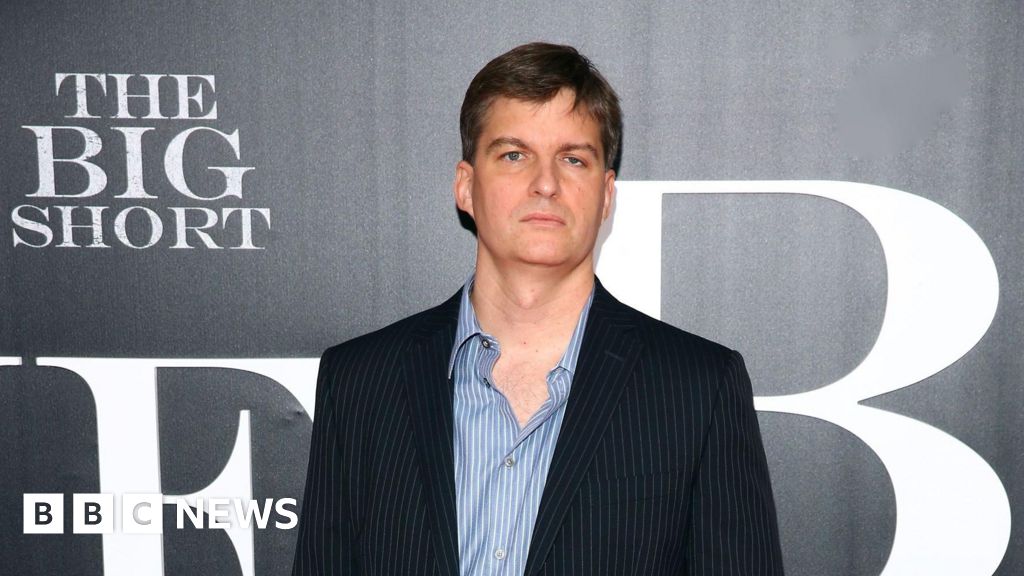

Shares of main expertise firms have fallen over fears concerning the valuations of companies linked to the substitute intelligence (AI) trade.Traders have grown rising cautious about what they’re calling an “AI bubble” this yr that has seen tech inventory valuations hit report highs. Main indexes in Asia have been the toughest hit on Wednesday, following a sell-off within the US. Japan’s Nikkei 225 closed 2.5%, dragged decrease by tech funding big, SoftBank, which plunged greater than 10%.AI valuation considerations took maintain within the US as properly after it was revealed the dealer who impressed The Huge Quick has guess $1.1bn (£840m) on a fall in costs for AI-related shares Nvidia and Palantir.Hedge fund investor Michael Burry, who was performed by actor Christian Bale within the 2015 movie The Huge Quick, a movie about merchants who made hundreds of thousands from predicting the collapse of the US housing bubble in 2008, has turned his consideration to AI.Mr Burry’s firm revealed it has purchased monetary merchandise, referred to as choices, that may pay out if the worth of AI-linked firms Nvidia and Palatir shares fall.It comes after the dealer posted on X: “Typically, we see bubbles. Typically, there’s something to do about it. Typically, the one successful transfer is to not play.”Markets worldwide have climbed in over the yr as traders positioned their chips in firms linked to AI, together with Nvidia, Intel and AMD.”It appears fatigue over AI and the present earnings run has traders questioning the sustainability of the AI hype. That is dragged down AI firms in a single day in markets,” mentioned monetary analyst Farhan Badami.Many jumps in tech shares have been linked to main investments in companies. For example, Amazon shares hit an all-time excessive on Monday after the announcement of a $38bn cope with OpenAI.However the shares of many tech companies fell on Wednesday. Amazon’s inventory dipped by 1.84% and notably, Nvidia – just lately the primary firm to ever be valued at $5tn – dropped by near 4%.SoftBank, one in every of Japan’s largest companies, suffered one in every of steepest drop in shares. The autumn weighed particularly onerous on Japan’s Nikkei index.The funding agency has invested closely in AI growth, channelling billions into tech firms like OpenAI, Intel and different gamers within the sector.SoftBank’s decline stems from the current “sharp rally” in its shares, which funding analyst Vincent Fernando describes as a “double-edged sword”. The surge can appeal to traders, but in addition leaves the inventory weak to pullbacks each time market sentiments shift, he mentioned.”The market can fear if the corporate is overspending on AI and will not make a enough return on that spend,” mentioned Mr Fernando from funding consultancy Zero One.Tech shares additionally took successful elsewhere in Asia. South Korea’s Samsung fell by greater than 4% whereas the nation’s inventory alternate index, the Kospi, was down by 2.85%.TSMC, which makes semiconductors for Nvidia, was fell practically 3%.Mr Badami from monetary providers agency eToro believes the correction amongst tech shares will proceed over the following yr.”Traders appear to be feeling that among the super-high valuations on the market aren’t making sense, and AI enthusiasm has undoubtedly fuelled these stretched valuations.”Spending inside AI-focused tech companies has been “actually excessive, and for some firms, they don’t seem to be making sufficient cash to justify the spending,” mentioned Mr Badami.

Trending

- Whisky industry faces a bleak mid-winter as tariffs bite and exports stall

- Hollywood panics as Paramount-Netflix battle for Warner Bros

- Deal or no deal? The inside story of the battle for Warner Bros | Donald Trump

- ‘A very hostile climate for workers’: US labor movement struggles under Trump | US unions

- Brixton Soup Kitchen prepares for busy Christmas

- Croda and the story of Lorenzo’s oil as firm marks centenary

- Train timetable revamp takes effect with more services promised

- Swiss dealmaking surges to record highs despite strong franc