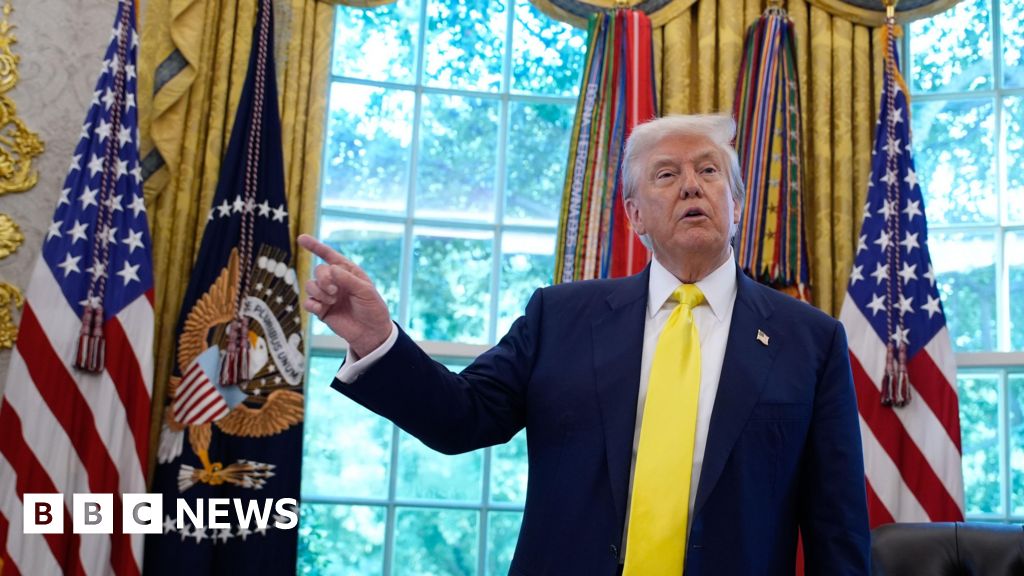

US President Donald Trump is pushing to make it simpler for People to make use of retirement financial savings to spend money on cryptocurrencies, non-public fairness, property, gold and other forms of non-traditional belongings. On Thursday, he ordered regulators to search for methods to vary guidelines that may discourage employers from together with such choices in office retirement accounts, identified within the US as 401ks. The transfer is meant to ultimately give on a regular basis employees new entry to investments previously reserved for rich people and establishments, whereas opening up beforehand untouched swimming pools of funding for corporations in these fields. However critics say it might enhance dangers for savers.Most employers within the US don’t provide conventional pensions, which include a assured payout after retirement. As an alternative, staff are given the choice of contributing a part of their pay cheque to funding accounts, with employers sometimes bolstering with further contributions. Authorities guidelines have traditionally held the corporations providing the accounts chargeable for contemplating components similar to danger and expense. Prior to now, employers have shied away from providing investments like non-public fairness, which frequently have larger charges and face fewer disclosure necessities than public corporations and might be much less simple to transform to money. The order provides the Division of Labor 180 days to assessment guidelines and consultants mentioned any change was unlikely to be felt instantly. However funding administration giants similar to State Avenue and Vanguard, identified for his or her retirement accounts, have already introduced partnerships with the likes of different asset managers Apollo World and Blackstone to start out providing private-equity centered retirement funds. Trump’s private enterprise pursuits embody corporations concerned with crypto and funding accounts. The Division of Labor in Might rescinded steerage from 2022 that urged corporations to train “excessive care” earlier than including crypto to funding menus in retirement accounts.Throughout Trump’s first time period, the Division of Labor issued steerage aimed toward encouraging retirement plans to spend money on non-public fairness funds, however considerations about litigation restricted take-up and former President Joe Biden later revoked it.

Trending

- Aiarty Video Enhancer Update Adds New AI Models and Control Options – Get 36% Off Now

- IAS Moves Beyond Verification With New AI Agent for Ad Campaign Optimizations

- Nissan Leaf production starts in Sunderland

- Sony ZV-E10 II gets 4K 120 fps recording with free upgrade

- Empty shelves fill Coventry food hub volunteers with dread

- ARRI Reaffirms Commitment to Lighting and Camera Systems – Full Roadmap for 2026, Munich Consolidation Underway

- Brussels to give carmakers breathing space on 2030 climate targets

- Canada clears way for $60bn Anglo Teck merger