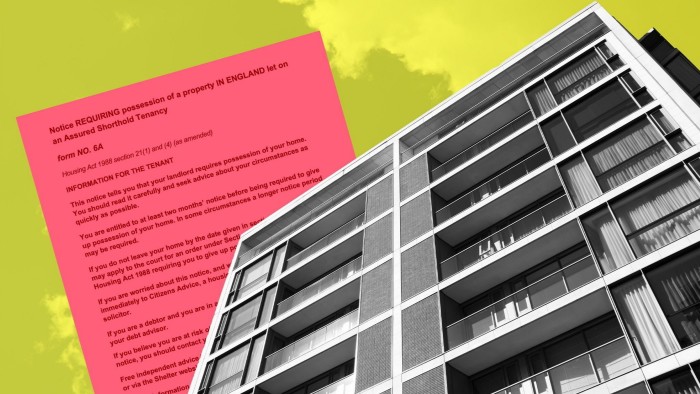

I’m determined to promote the flat I bought in my 20s as I must recoup the deposit. Nevertheless, the tenants are behind on hire and haven’t moved out following the expiration of the part 21 authorized discover I served to regain possession of my property. With out hire, I can not cowl the mortgage I’ve on the property, so it’s inflicting me grave monetary points. What’s the quickest route for evicting the tenants?Neli Borisova, senior affiliate at JMW Solicitors © Headshot of Neli Borisova, senior affiliate at JMW Solicitors Neli Borisova, senior affiliate within the business litigation crew at JMW Solicitors in London, says sadly it is a frequent state of affairs, which might destroy a previously amicable relationship between a landlord and a tenant. When tenants fall into arrears, some landlords focus solely on recovering the arrears whereas lacking the larger image. This will inadvertently compromise their monetary pursuits. Till you will get again possession of your property, your losses by means of arrears might solely proceed to extend.You’ve appropriately recognized that the precedence in resolving the state of affairs is to regain possession as shortly as doable. Probably the most simple approach is to difficulty an accelerated possession declare. That is simply accomplished by finishing a normal type NB5, which might be discovered on the gov.uk web site, and lodging it along with your native county courtroom. Supplied that you’ve complied with all landlord’s authorized obligations, a decide will assessment your declare and make a possession order with out the necessity for a listening to. You may then ask the county courtroom bailiffs to evict your tenant.Individually, you may make a cash declare on-line for the hire arrears. Nevertheless, you need to fastidiously think about whether or not that is worthwhile, relying on the worth of the arrears and the tenant’s seemingly capacity to pay. Making a cash declare on-line is comparatively simple, however it’s going to take some effort and time, which could not be price it if you realize that the tenant can not afford to repay you. Chatting with them and reaching a compromised settlement is likely to be a greater choice.Alternatively, you may make only one declare — a normal possession declare — and search possession and a cash judgment on the similar time. Nevertheless, this can require not less than one courtroom listening to and it’ll in all probability be a slower path to possession. Contemplating that any delay is inflicting you vital monetary difficulties and you might be determined to promote the flat, this feature will solely be preferable the place there’s some complication which implies you can not use the accelerated route (for instance, if there was a delay in defending the deposit, otherwise you not have a duplicate of the preliminary gasoline security certificates).It’s at all times price exploring any chance to succeed in an settlement along with your tenant the place, for instance, they go away voluntarily in alternate for a discount of their debt. You’ll know out of your earlier dealings with the tenant whether or not it is a viable choice. If not, you need to take steps to difficulty a courtroom declare immediately.A promotion will take me into a better tax bracket. Ought to I take it?I at all times wished to progress in my profession, however the considered shifting into a better tax bracket and doubtlessly being worse off has put me off desirous to climb the ladder. I’m caught at a crossroads of what to do subsequent. Any recommendation?Will Stevens, head of wealth planning and companion at Killik & Co © Headshot of Will Stevens, head of wealth planning and companion at Killik & Co Will Stevens, head of wealth planning and companion at Killik & Co, says the tax system in any nation is designed to boost income for the federal government; nevertheless, one other key operate of any tax system, whether or not intentional or not, is to create incentives for behaviour. On that second measure, it’s clear that the UK tax system results in unintended penalties. Analysis we carried out lately recommended that a couple of in 5 people presently incomes over £100,000 restrict their profession development to keep away from falling into sure tax brackets. Moderately than going for promotions and pay rises they’re exploring methods to construction their earnings. That’s hindering their very own prospects, but in addition negatively impacts the potential for development within the UK.Everybody in Britain has a private allowance of £12,570, after which they start paying tax, beginning at 20 per cent, then 40 per cent and rising to 45 per cent on earnings over £125,140. Along with this, there’s nationwide insurance coverage. Nevertheless, these are marginal charges of earnings tax and subsequently it is very important observe that even at earnings of £100,000, your complete earnings tax paid on earnings would equate to only over 27 per cent.When a person begins incomes greater than £100,000, they start to lose their private allowance, at a charge of £1 for each £2 in earnings over the brink. This creates an efficient marginal earnings tax charge of 60 per cent. By the point somebody has earnings of £125,140, subsequently, their efficient charge of earnings tax throughout all earnings has jumped to about 32 per cent of all earnings.Our subsequent questionI am within the strategy of getting divorced and was anticipating to pay little one upkeep via the kid upkeep service (CMS). I’m a better earner with a gross annual earnings of £250,000, however I learn that the CMS has a cap on upkeep paid by increased earners over £156,000 every year. Does this imply my little one upkeep will probably be capped? The image will get a lot worse for folks with youngsters at nursery. The £100,000 threshold creates a right away cliff edge, in order that the household loses its entitlement to free childcare if even one member earns over £100,000.There are methods for people to try to handle a few of these points, notably the 60 per cent marginal charge of earnings tax. Nevertheless, these depend on good planning, being conscious of your complete earnings place, and the allowances accessible to you. For instance, earners on this class might select to sacrifice a part of their remuneration for pension contributions, which has the impact of decreasing your complete earnings by the quantity contributed. This will have the double optimistic impact of decreasing your tax charge whereas growing your retirement financial savings. Nevertheless, this comes on the expense of getting cash to spend month-to-month and is probably not proper for everybody. The opinions on this column are meant for common data functions solely and shouldn’t be used as an alternative to skilled recommendation. The Monetary Instances Ltd and the authors will not be accountable for any direct or oblique outcome arising from any reliance positioned on replies, together with any loss, and exclude legal responsibility to the total extent. Do you may have a monetary dilemma that you just’d like FT Cash’s crew {of professional} specialists to look into? E mail your drawback in confidence to cash@ft.com.

Trending

- Lawyer suspended after criticizing client’s mothering skills in response to negative review

- Banana Republic Mines Its Archive to Inspire Modern Brand Love

- How to deliver monthly PPC reports clients love

- 10 Best rich chocolate whey protein: For fitness, recovery and effective workout

- Murdoch’s TikTok? Trump offers allies another lever of media control | US news

- Suzuki’s new logo is a modern triumph

- How the Deal Got Done: Debevoise and Cerberus/ECI

- Databricks will bake OpenAI models into its products in $100M bet to spur enterprise adoption